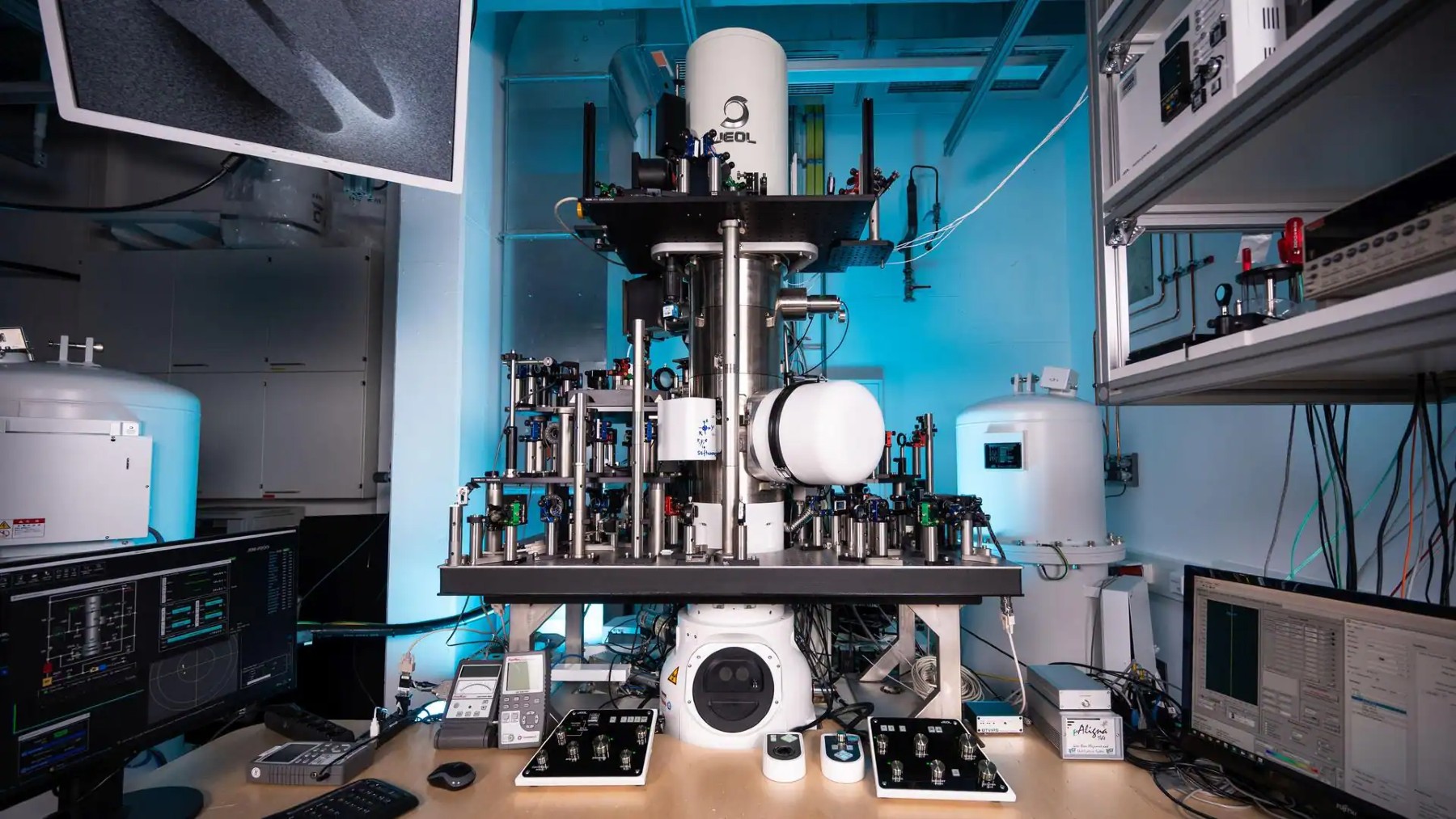

University of Arizona researchers have built the world’s fastest electron microscope that stops motion at a mind-boggling one quintillionth second. This revolutionary ‘attomicroscope’ lets us see what was impossible – the electron movement, and opens a new vista into quantum physics, chemistry, biology, etc.

This new microscope enables scientists to, for the first time, watch atomic-scale processes happen in real time, which could unlock new knowledge in materials science, drug development, and nanotechnology. This advancement in microscopy technology is a significant achievement that has brought us closer to grasping the composition and control of matter.

The attomicroscope’s incredible leap forward: See electrons move in real-time like never before

The attomicroscope is a breakthrough in microscopy technology, surpassing prior attempts at recording the brief micro-world, even at 43 attoseconds – inconceivably short time spans. Using electron pulses that last for only one attosecond, this new microscope is slowing down time to see ultrafast electron movement that was too fast to have been observed until now.

The advancement extends from the Nobel Prize recipients Pierre Agostini, Ferenc Krausz, and Anne L’Huilliere, who initially produced a light pulse that was measurable in attoseconds. This step forward in time detail means scientists can now look at fundamental processes in atoms and molecules in more detail than before, possibly leading to a new understanding of quantum mechanics and chemical reactions at their most superficial level.

Unraveling the science behind the world’s fastest microscope and how it freezes time

The operation of the attomicroscope, in essence, is based on an intricate balance between lasers and electron beams. The process starts with a shot of ultraviolet light shining directly onto a photocathode to emit ultra-fast electrons within the microscope. The probe light is then divided into two beams, one vertically polarized and the other horizontally polarized.

These beams arrive at slightly different times to produce a ‘gated’ electron pulse to image the specimens at the atomic levels. This delicate interplay between light and electrons makes it possible to obtain responses at such short time scales that usually only last one attosecond – which is equivalent to one billionth of a billionth of a second, or as some say, there are as many attoseconds in a second as there are seconds in 31.7 billion years.

The future of science and technology will never be the same after this breakthrough microscope

In conclusion, advancing the attomicroscope can bring forth a myriad of potentials in numerous fields of science. In physics, it has made it possible to observe the movement of electrons, which can be used to change views on quantum mechanics. In chemistry, the direct observation of electron movement can revolutionize the study and control of chemical reactions on the molecular level.

This technology may help discover new aspects of the processes happening in the cells in the fastest time, thus enhancing our understanding of life from the molecular perspective. It is not merely a scientific piece of equipment as it has numerous applications in material science and nanotechnology, where the study of electrons is paramount in creating new materials and gadgets.

Freezing time at the attosecond scale: Discover how this microscope redefines our understanding of the universe

In conclusion, the invention of the world’s fastest electron microscope is undoubtedly one of the turning points in human history. Thus, freezing time at the attosecond scale opens a new world that makes the observation of the universe’s processes at the level of temporal resolution impossible. This discovery revolutionized what can be observed and quantified, as well as time and space concepts.

As we find ourselves at the cusp of this new ground, the attomicroscope can redefine several disciplines, including quantum mechanics and biology. The fact that electrons are observed in motion can be leveraged in thousands of ways for numerous scientific and technological breakthroughs.

Thanks to this technology, scientists and researchers can map out new areas of study and pave the way for many more innovations that will define the future. The attomicroscope is a prime example of humankind’s endeavor to make the most of technology and turn our hearts, minds, and souls toward revealing and comprehending the universe to its finest bits ever imaginable.