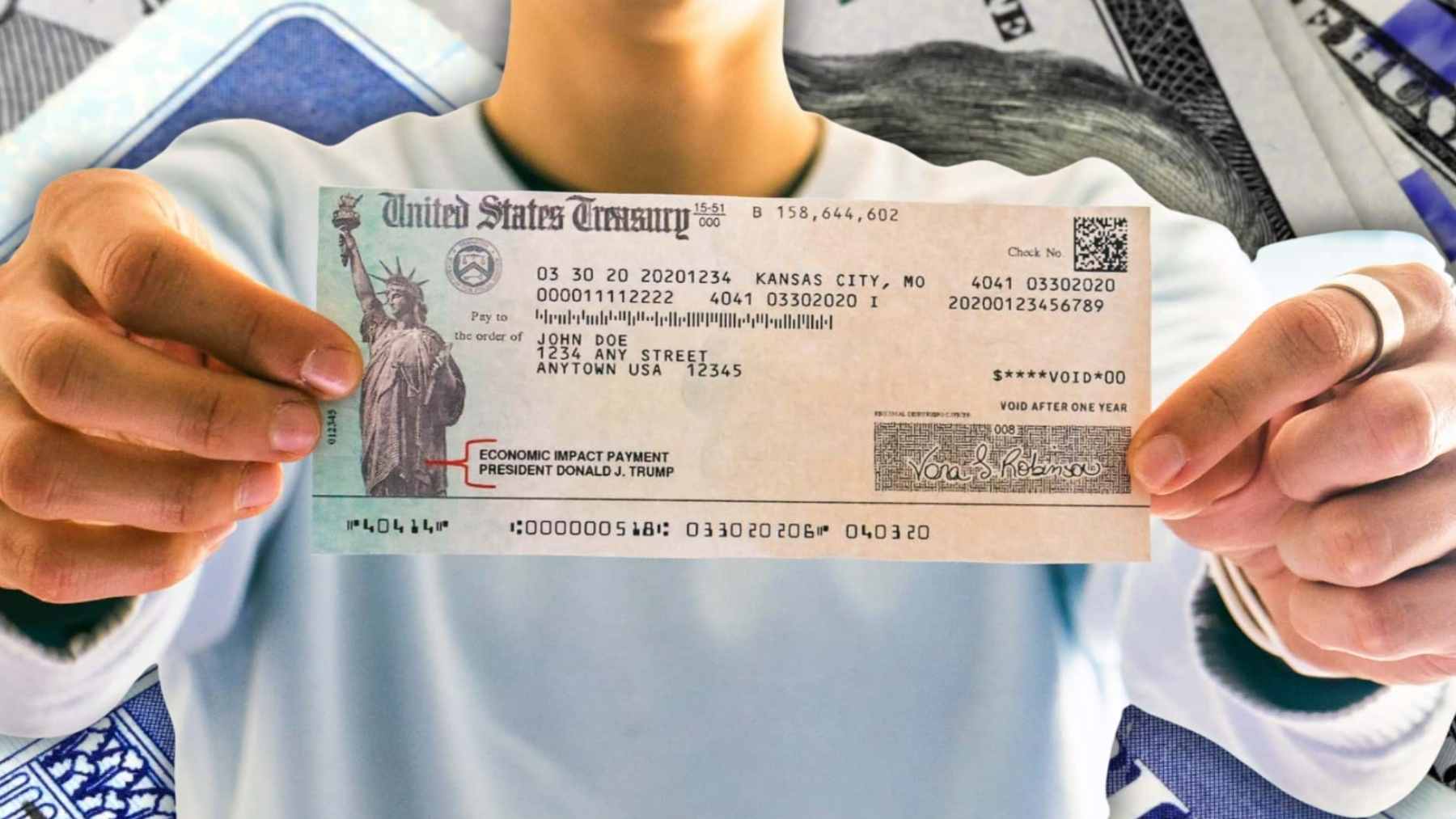

With the tax season officially coming to a close last April, taxpayers can expect to begin receiving their refunds this month. Tax refunds occur when you have overpaid the IRS on your tax liability. While not everyone will receive a refund, according to past data from the IRS, about two-thirds of taxpayers are issued refunds after filing their taxes. For the next few weeks, the Internal Revenue Service (IRS) will be sending out refunds to taxpayers. Make sure you check if you might be receiving a refund this week.

The IRS could withhold your refund

While many taxpayers are expecting refunds to be processed this week, some may find that their refunds are being withheld. This can occur for a variety of reasons, but it usually occurs when you still owe the IRS or other federal entities money. For example, if you have paid your federal taxes but still owe state taxes, the IRS may withhold your federal tax refund until you pay your state taxes.

Other reasons as to why your refund may be withheld are due to you having outstanding federal student loan repayments, or if you owe spousal or child support. If you are in a position where your refund is being withheld, you must contact the U.S. Department of the Treasury’s Bureau of the Fiscal Service (BFS) to help you determine the way forward with regard to the payments you may owe.

Who will get a tax refund next week?

When it comes to filing your taxes, there are two ways to do it: either electronically or by mailing your returns. Generally speaking, if you opt to file online, your refund will be processed sooner than if you mail your tax return documents. Refunds are issued within 21 days, with the average time for e-filing refunds to be processed being closer to three days.

If you filed your taxes at the end of April, just before the deadline, and you opted to have your refund distributed to you through direct deposit, next week would be the approximate 21-day mark when you can start to expect a refund from the IRS.

To check to see what your refund status is, you can use the IRS “Where’s My Refund?” tool. According to the IRS official April 25 statistics, the average taxpayer for this year was issued a refund of $2,945. If, however, you are expecting a refund but have not yet received it, use the tool to check where your refund status is, or to confirm if you are actually expecting a refund or not.

“If you think we made a mistake with your refund, check Where’s My Refund or your online account for details,” describes the IRS website.

How to lower your federal tax liability

If you find that your refund is being withheld by the IRS because you still owe the government money in taxes, for next year, there are methods you can draw upon to reduce your overall tax liability. One way you can do this is to ensure that you are applying for all tax credits that may be relevant to you. Check the eligibility criteria and apply for them next year to reduce your overall liability.

On the other hand, if you own multiple assets or have multiple sources of income, you should also investigate ways to lower your tax liability, as the more income you earn, the higher your taxes are. Taxpayers who own assets can claim, for example, a capital loss to reduce their overcome liability. Always ensure that you file your income taxes, even if you are in a position where you cannot pay them. This will ensure you do not further increase your liability by incurring penalties.