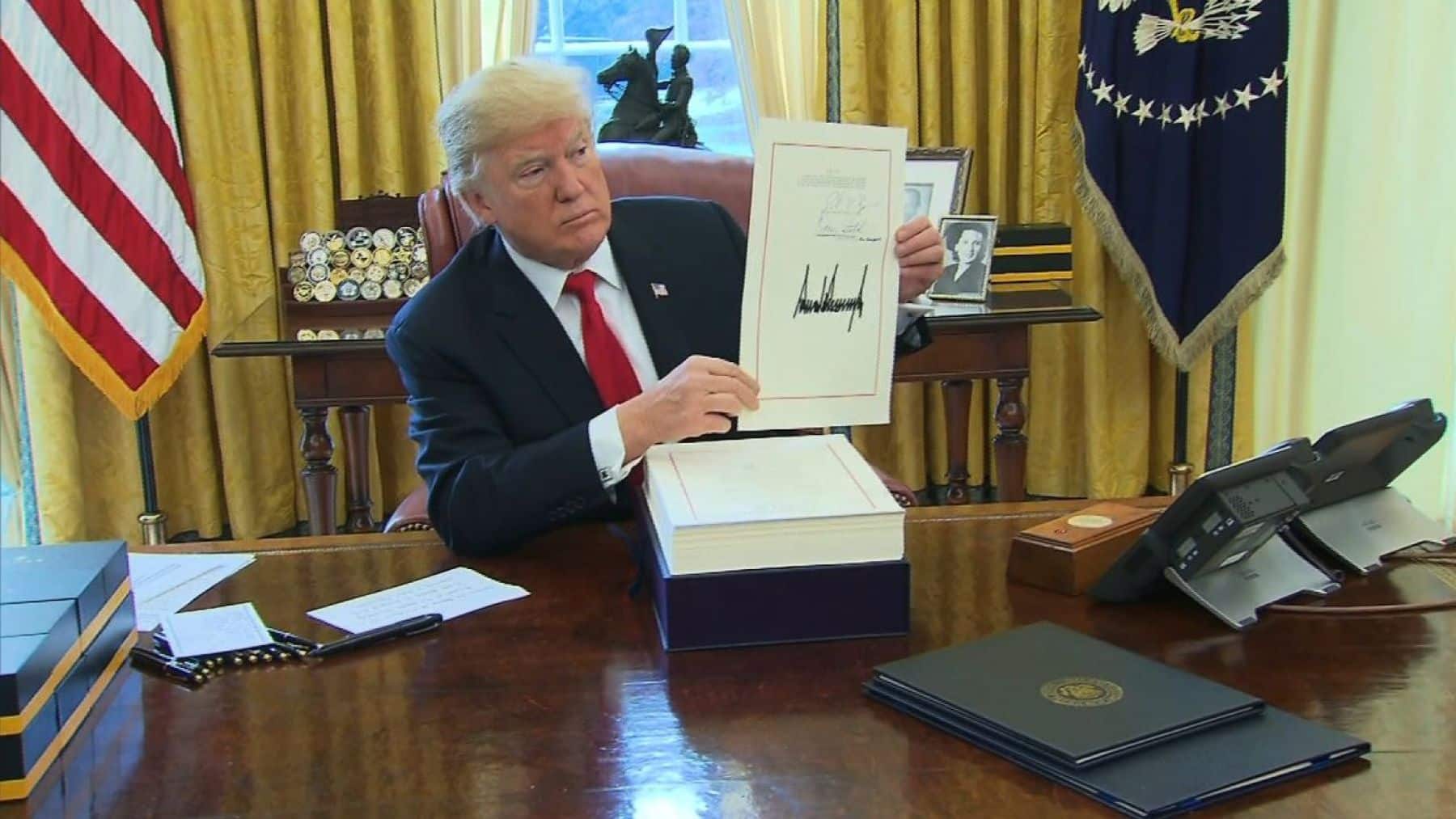

Social Security is set to undergo significant changes in both the immediate and distant future. With questions on how to extend the fund’s longevity, as well as a new administration taking office with the recent election of President Donald Trump for his second non-consecutive term, beneficiaries can brace themselves for new policies to be implemented. Starting next month, there may also be additional challenges coming for the fund.

Problems the fund is currently facing

Since its inception, Social Security has been a vital government assistance program for retirees, disabled individuals, survivors, and low-income individuals with little to no resources. Currently, the program serves nearly 70 million beneficiaries, with the retirees making up the largest percentage of beneficiaries. The average retiree receives just under $2,000 a month in benefits from the program, with a large number of these beneficiaries relying solely on these payments to cover their monthly expenses.

Currently, the fund is expected to be depleted by the early 2030s. This is largely because people are living longer, which means they are receiving benefits for longer. In addition, the workforce is not keeping up with the growing number of retirees due to people not having as many children anymore as they once did, which means the Social Security taxes, which are paid into the program that then fund beneficiaries’ payments, are not able to sustain the program.

Drastic changes needed for the fund’s future

If action is not taken by Congress, the depletion would mean that beneficiaries would see their benefits reduced by approximately 20%. While the fund is projected to be depleted within the next decade unless a change is made. However, the former head of the Social Security Administration has recently stated that we could see the entire system collapse by April this year.

“Ultimately, you’re going to see the system collapse, and there will be an interruption of benefits,” said Martin O’Malley, former Social Security commissioner under the Biden administration, to CNBC reports. “I think that will happen within the next 30 to 90 days.”

Part of O’Malley’s reasoning behind this is because the new Department of Governmental Efficiency (DOGE) headed by Tesla CEO Elon Musk is making significant funding cuts across governmental agencies. DOGE has been hired by the Trump administration as an external agency to suggest implementations on how to reduce unnecessary government spending. This has seen large amounts of government employees be retrenched, as well as large funding cuts. DOGE has planned to close 45 Social Security Administration offices across the nation.

Social Security remains a vital cornerstone for Americans

What is clear, is that the future of the fund needs to be sorted out as soon as possible. With millions relying on it to support them in their retirement, the fund cannot afford to be in a state of collapse. Lawmakers and government officials need to prioritize finding a solution that is going to benefit both current and future beneficiaries.

Currently, the solution to extending the longevity of the fund falls into two camps: Cutting benefits now, or raising Social Security taxes. While Trump has previously stated during his presidential campaign that neither of these options are to be implemented, the bigger question is finding a way to completely restructure the fund so that it can support the changing conditions of the workforce.

With the current state of the Social Security program, current working individuals are encouraged more than ever to investigate a diverse portfolio of investment and saving options for their retirement. The administration has always advised against solely relying solely on Social Security payments for your retirement, and beneficiaries would be wise to ensure they have multiple avenues of income for their retirement.