The forward-thinking and the innovative Tesla is facing scrutiny as troubling data emerges from China- Tesla’s largest electric vehicle market. According to GLJ Research, Tesla’s registrations in China dropped by a staggering 83 percent during the week of March 31 to April 6. This fall has been deemed the most severe week-over-week fall among leading electric vehicle brands in the country. This drastic decline comes at a time when competition from the local Chinese EV manufacturers is continuing to escalate and is posing a rather significant challenge to Tesla’s international market share.

GLJ Research, maintaining a Sell rating on Tesla stock, emphasized that, “things appear to be worsening” for the company. All of the current research suggests that the decline may not just be a temporary fluctuation in statistics but part of a deeper issue in Tesla’s overseas demand and overall positioning.

More about the GLJ research

According to GLJ Research, shares of Tesla Inc. ended Tuesday 4.9% lower extending the loss to a fourth consecutive season. For the week ending April 6, only 3,600 vehicles were registered. This is down from 21,000 vehicles registered just the previous week.

Nio recorded 1,800 registrations which is a 40% drop in comparison to the previous week’s registrations of 3,000. Chinese EV makers are, however, logging in a 21% weekly gain to 7,500 units.

However, irrespective of the steep week-over-week decline, Tesla China’s latest figures indicate a 3% rise year-to-date and a 91% improvement over the first week of the second quarter. All the data pertaining to Tesla is not entirely negative and optimism is the order of the day in terms of Tesla’ future.

Some optimism for Tesla despite the research from China

Contradictory to the rather concerning numbers from China, Tesla shares surged nearly 5 percent on Friday, signaling a rebound after two weeks of losses. Much of this investor’s optimism appears to be tied to political developments. Investors remain hopeful that Tesla’s CEO Elon Musk could have much more influence within the new administration, potentially leading to policy shifts that could favor the company’s operations, especially in areas like autonomous driving.

While there are still reasons to be optimistic about Musk’s relationship with Trump, there is still uncertainty as to what this relationship would yield for Tesla as recent news mentioned that Trump is banned and will not drive Tesla for a certain reason.

A focus shift to AI and robotics despite auto market concerns

Tesla seems to be threading on uncertain grounds and Tesla’s vehicle sales are showing signs of weakness, particularly in core international markets. Thus, investor attention has even shifted to the company’s futuristic pursuits and interests in artificial intelligence and robotics.

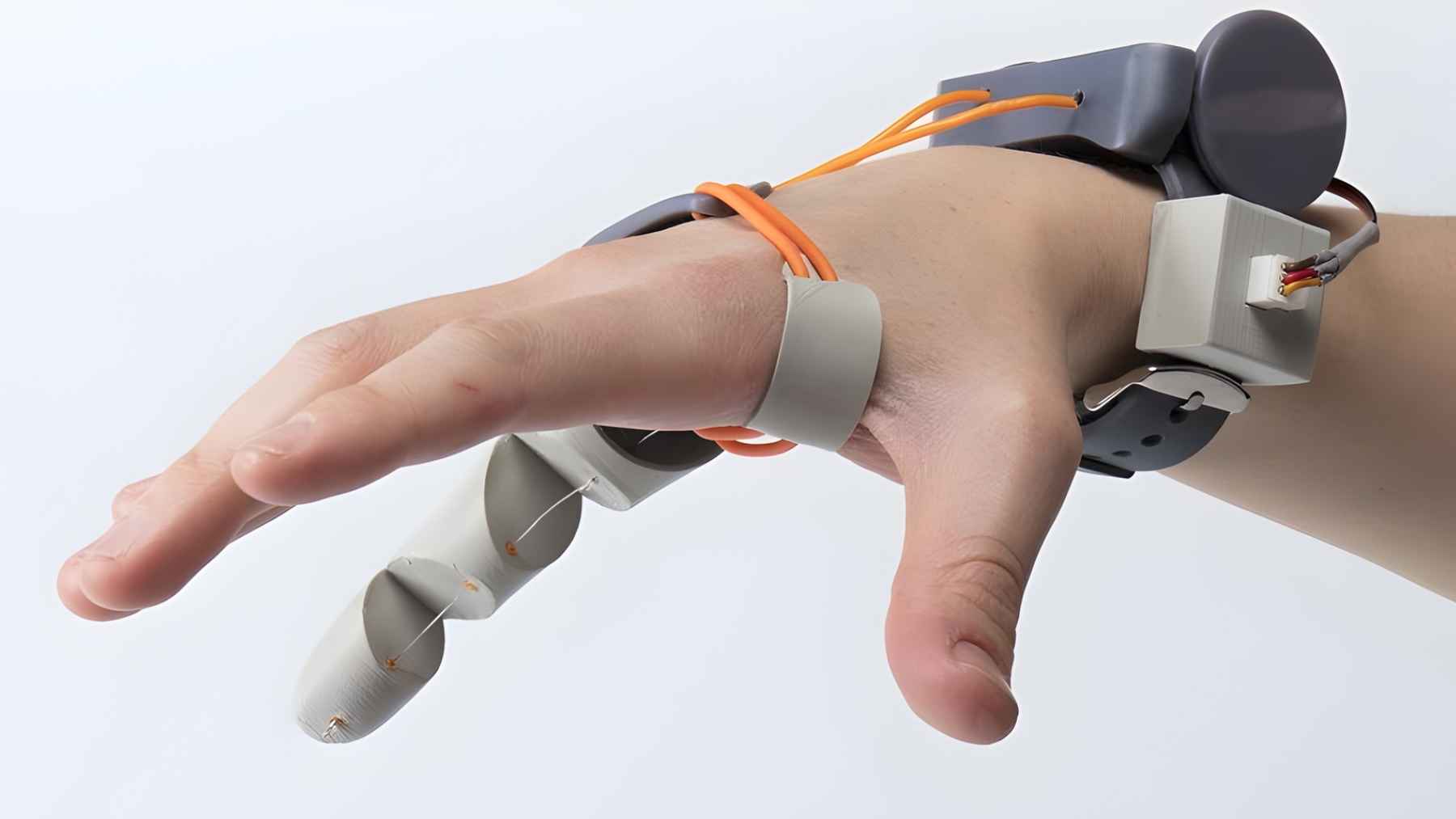

Morgan Stanley analyst Adam Jonas noted that recent investor discussions are far more focused on Tesla’s Full Self-Driving (FSD) technology, the development of its robotaxi fleet, and progress on the Optimus humanoid robot. These futuristic projects are gaining more and more attention, with expectations mounting for a possible AI-focused event showcasing advanced autonomous features. Jonas reiterated an overweight rating and a $430 price target, citing Tesla’s potential to bridge growing gaps in AI-driven supply and demand.

The future of ideal for Tesla

Despite the fact that enthusiasm for Tesla’s long-term innovations remaining strong, the company’s core auto segment appears to be facing unsteady grounds. The sharp decline in Chinese registrations and rising competition with Chinese EV manufacturers pose further concerns about whether Tesla can maintain its leadership in the EV space. While Tesla’s competitive edge in the EV market seems highly unsteady at this point, there is hope that in time better technology will be in development under Tesla’s brand.

As is, Tesla’s Elon Musk is introducing Tesla’s robot to its worst enemy and it is a robot that is said to have “superhuman” capabilities.