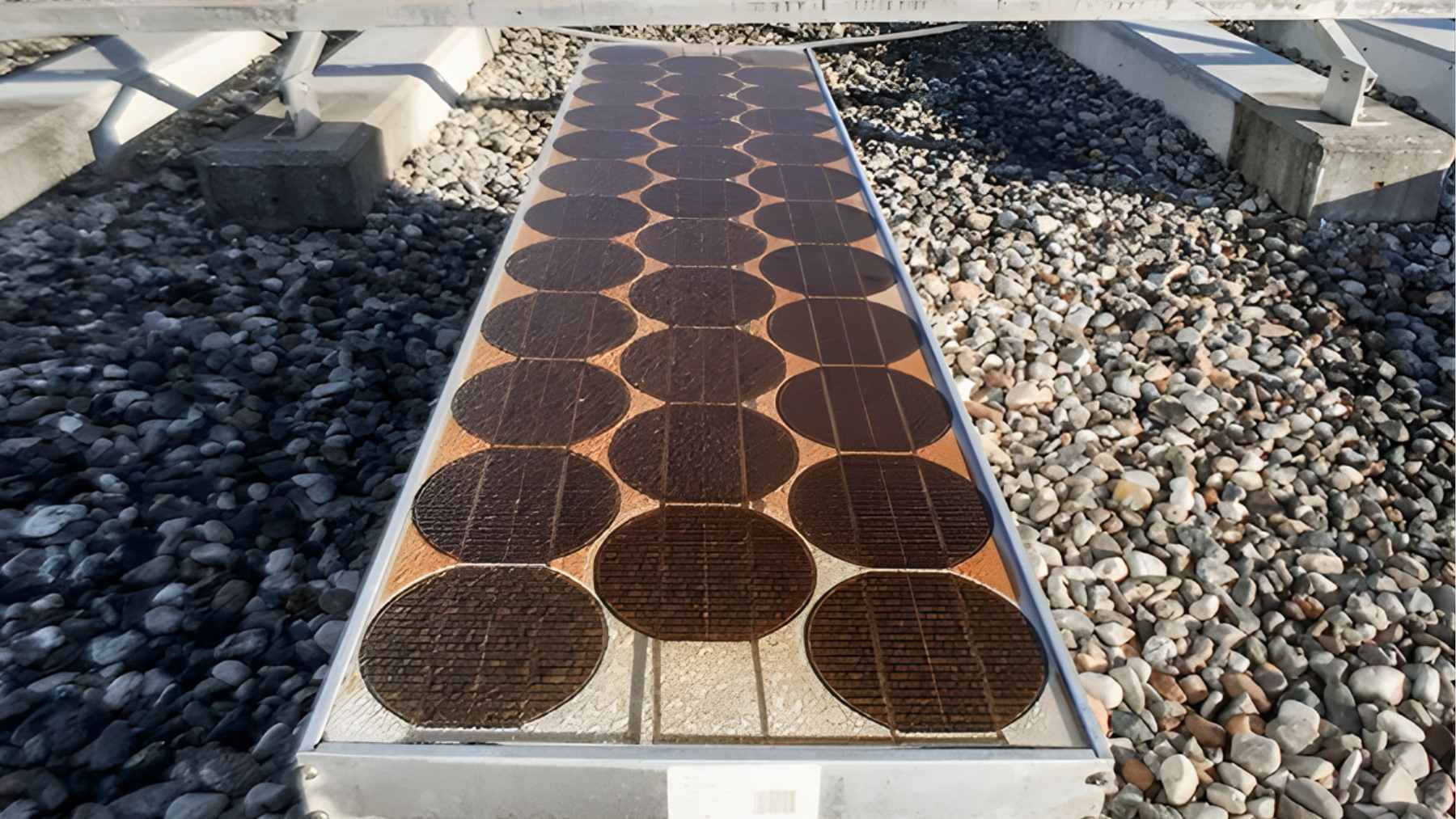

Due to ongoing war of tariffs between America and China, it’s not surprising that America is prepared to declare war yet again. The United States is intending to impose steep tariffs on solar cells imported from Southeast Asia. This move could further escalate the already rising tensions with China.

This decision to impose these tariffs, however, is a result of a year-long trade case initiated by American solar manufacturers who claim that Chinese companies have constantly been flooding the market with unfairly cheap solar panels thus undermining domestic production. The problem is that if these tariffs are finalized, it could have a rather profound impact for the global solar industry as well as for the U.S.-China trade relationship.

More about this trade case against Chinese manufacturers

The trade case had been brought to the fore by a coalition of companies that included Korea’s Hanwha Qcells and Arizona-based First Solar Inc., as well as several smaller solar producers. The premise of the case was that all the companies agreed that larger Chinese solar panel manufacturers solely operating in Malaysia, Cambodia, Thailand, and Vietnam have been shipping panels that were priced far below their cost of production.

The problem that was also brought to the table was that these larger Chinese solar panel manufacturing competitors were receiving unfair subsidies and, in the process, American-manufactured solar products were unable to compete. The petitioner group, known as the American Alliance for Solar Manufacturing Trade Committee, asserted that this practice from Chinese solar manufacturers had caused detrimental harm to U.S. solar manufacturing investments.

What will result from finalized tariffs?

Steep tariffs have to be finalized on majority of the solar cells from Southeast Asia by U.S. trade officials and this is a necessary step to put to bed the year-old trade case. It seems as if the tariffs differ largely depending on the company and country. For instance, Jinko Solar products from Malaysia received the lowest tariffs set at 41.56%. Rival Trina Solar products in Thailand are said to face tariffs of 375,19%. Cambodia took the hardest knock with products in Cambodia dealing with duties that are more than 3,500% specifically because Cambodia producers did not cooperate with the U.S. investigation. All of these measures have been implemented to clamp down on what the U.S. labels unfair trade practices by Chinese-owned companies in these four countries.

The resulting move in global solar trade dynamics

From the onset of the threat of these tariffs, there has already been somewhat of an impactful shit in global solar trade. All of the imports from the four targeted countries have reduced rather drastically. In the same vein, shipment of panels from regions such as Laos and Indonesia have risen. This shift highlights the broader impact of U.S. trade policies on a global supply chain and pinpoints how interconnected international markets are. Could this be China’s second fall? China already experienced one fall when the most wanted mine of all time was found in America.

Understanding political and legal repercussion

While these tariffs have been suggested, the finalization of the tariffs is dependent on approval by the International Trade Commission, which is scheduled to vote in June. The decision taken will be on whether the U.S. solar industry has been materially harmed by these imports. If these tariffs do get finalized, it could lead to a redefinition of the trade relationship between the U.S. and China and will potentially lead to even deeper trade conflict. Depending on the outcome of this case, U.S. trade policies may change with regard to the approach administered to protect domestic industries from unfair foreign competition.

Stakeholders in the solar industry will be keeping a close eye on the upcoming votes. However, there is hope that China may just sweep us off our feet even though it seems like America is winning this race too just like America won the space race.