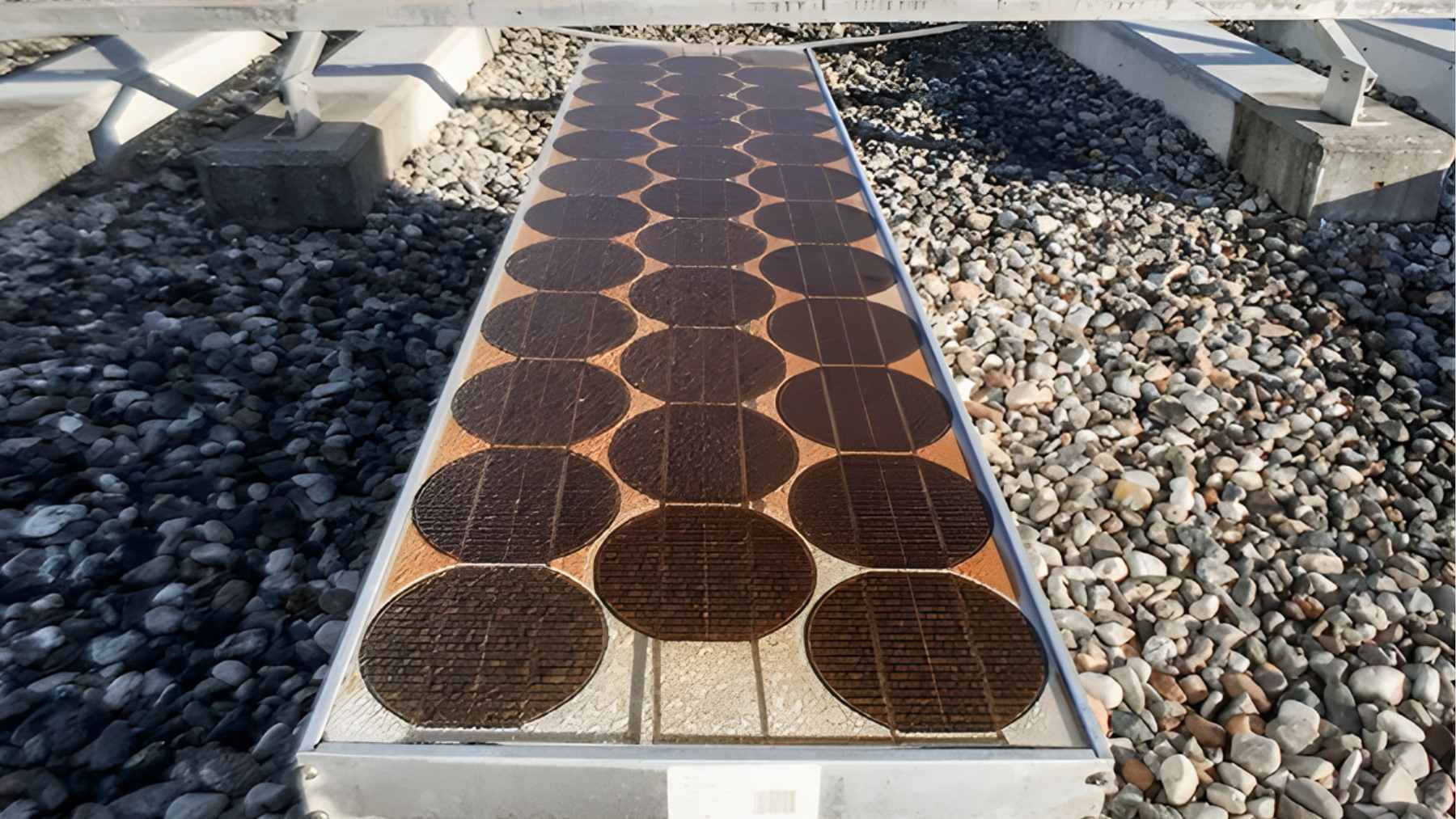

So much is happening in the solar power industry with China’s growing arms in the global market. Companies from China keep forging ahead with their manufacturing and opening lap factories in Southeast Asia, despite tariffs and trade wars dictating so many things. This indicates the capability of Chinese manufacturers, as well as lacunae in American policy, which shape solar energy into its future.

China’s solar market shares 80% of the pie globally at this time when the US decline is happening

The rise of China as an emerging player in the solar industry has been powered by state-backed subsidizations and aggressive investments in manufacturing technologies. Over two decades, Chinese companies have cornered about 80% of the world’s market share on solar panels.

Once a solar manufacturing giant, the US has slumped as the industry within the country receded, with costs among others cited as advantages that Chinese companies go by globally. Chinese firms, however, have been met with tariffs from the US starting in 2012. They, however, have not stood still but rather sought alternative measures to keep their doors open.

Production has continued, but as an alternative, production activities have been relocated to Southeast Asia, where the products could easily be shipped without the intended reassessment of tax duties on Chinese-made products. Vietnam, Thailand, and Malaysia have become great manufacturing bases for the thousands of Chinese-owned solar plants which still allow firms to keep their teeth into the world market, especially lucrative US soil.

US tariffs nudged Chinese solar manufacturers out of the country and yet, to Southeast Asia

Indeed, US trade policies, especially tariffs that are aimed at Chinese solar imports, have many implications on US manufacturers as well as on the international solar industry. The tariffs, which are now bigger than 300% for some Chinese producers, have made companies change their production strategy dramatically.

Those who formerly manufactured in China are now offshore in Southeast Asia, specifically Vietnam and Thailand, but some have recently gone to hotspots such as Laos and Indonesia. This gives room for Chinese solar manufacturers to escape the US tariffs and still supply affordable products for American customers.

Solar exports to these Southeast Asian countries saw a steep rise due to the spike of imports in the US from nations such as Vietnam and Malaysia. Even while the US government tightens the noose a little further with the new tariffs, Chinese companies still find ways to adapt, and that remains one of the prisms through which one can see what defining features of the “cat and mouse” game between trade regulators and manufacturers are in the global dynamics of the solar industry.

Chinese solar giants introduce $1 billion Saudi solar plant to extend their overall reach

However, recently, Chinese solar power companies have also expanded their ambitions beyond Southeast Asia; much of their expansion strategy is aimed at other areas of the world, including the Middle East and Africa. In 2023, JinkoSolar-their name among the largest solar manufacturers in China-announced a funding agreement with Saudi Arabia for a $1 billion solar plant with a planned capacity of 10 GW.

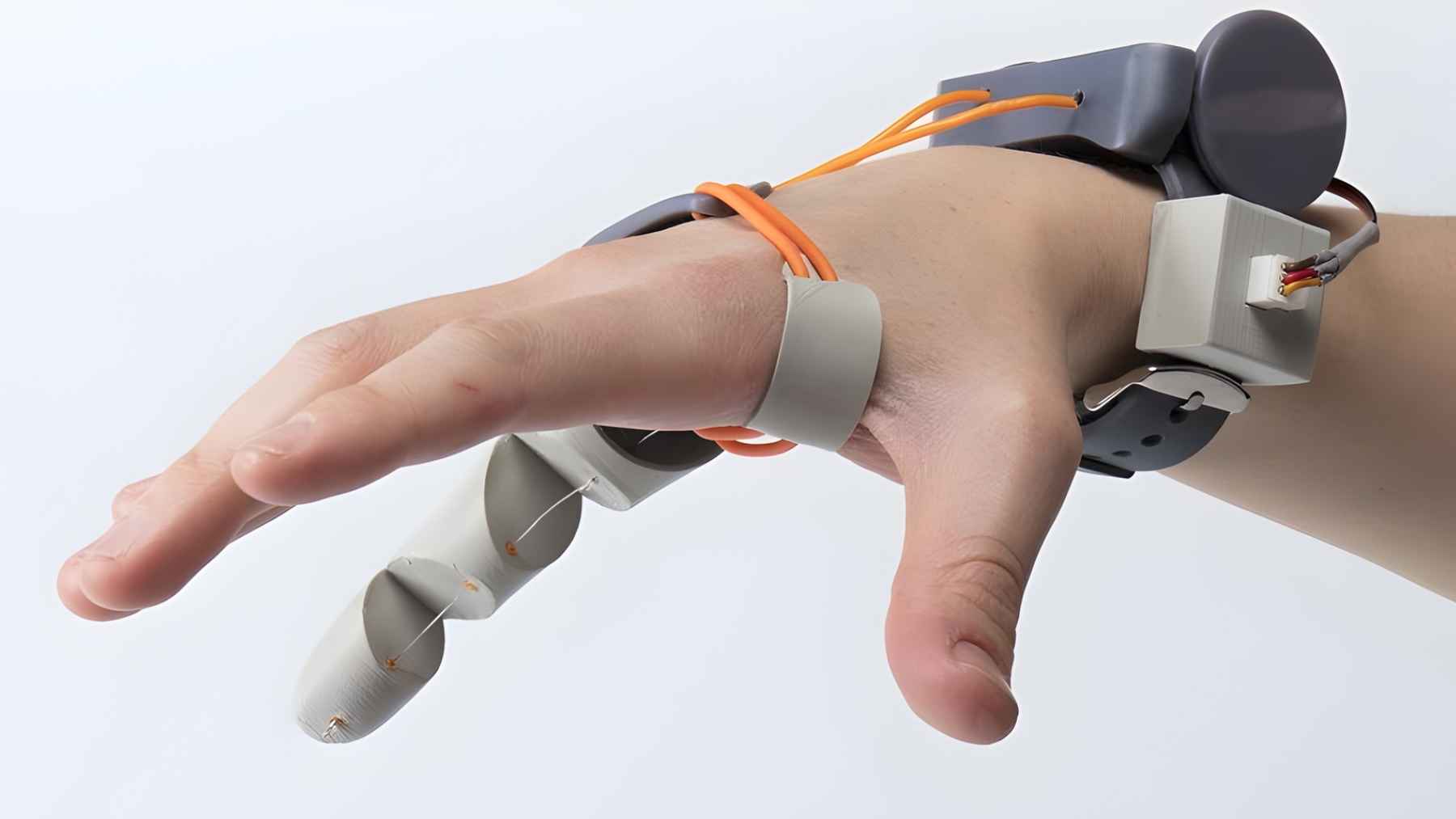

This particular action matches a greater strategic goal for China: that of reinforcing its position in new emerging markets as much as it capitalizes on the global trend in renewable energy. Chinese manufacturers, on the other hand, are heavily ramping up production in the US itself. The US government has introduced new incentives to fuel domestic solar manufacturing.

These incentives include tax breaks and grant provisions for companies who establish their factories in US soil. Because of these reasons, Chinese solar companies are setting up huge production facilities in the US to benefit from the incentives, with at least 20 GW production capacity slated for at least the next year.

This production capacity would serve almost half of the total solar demand from the US market. The different dynamics emerging within the solar power industry signal the flexibility of Chinese companies by helping them overcome trade restrictions and tariffs.

Because of its strength, China continues to dominate, revealing, if not itself, the invalidity of the US policy that holds power over its own market. With solar energy impacting climate change initiatives, the road ahead for the US in terms of reclaiming its old glory remains tough and challenging. The emerging few years are going to matter for the solar market writ large.