As we bid farewell 2025, we also say goodbye to tax breaks, as energy credits vanish after a rather transformative era for American households. The HR1, signed into law by President Donald Trump, has caused many of the energy credits to be rolled back. These energy credits were the reason that many American citizens chose to become more energy efficient. As the sun is slowly setting on these energy credits, Americans can anticipate the first consequences to hit soon.

Energy credits vanish, and homeowners face a financial setback

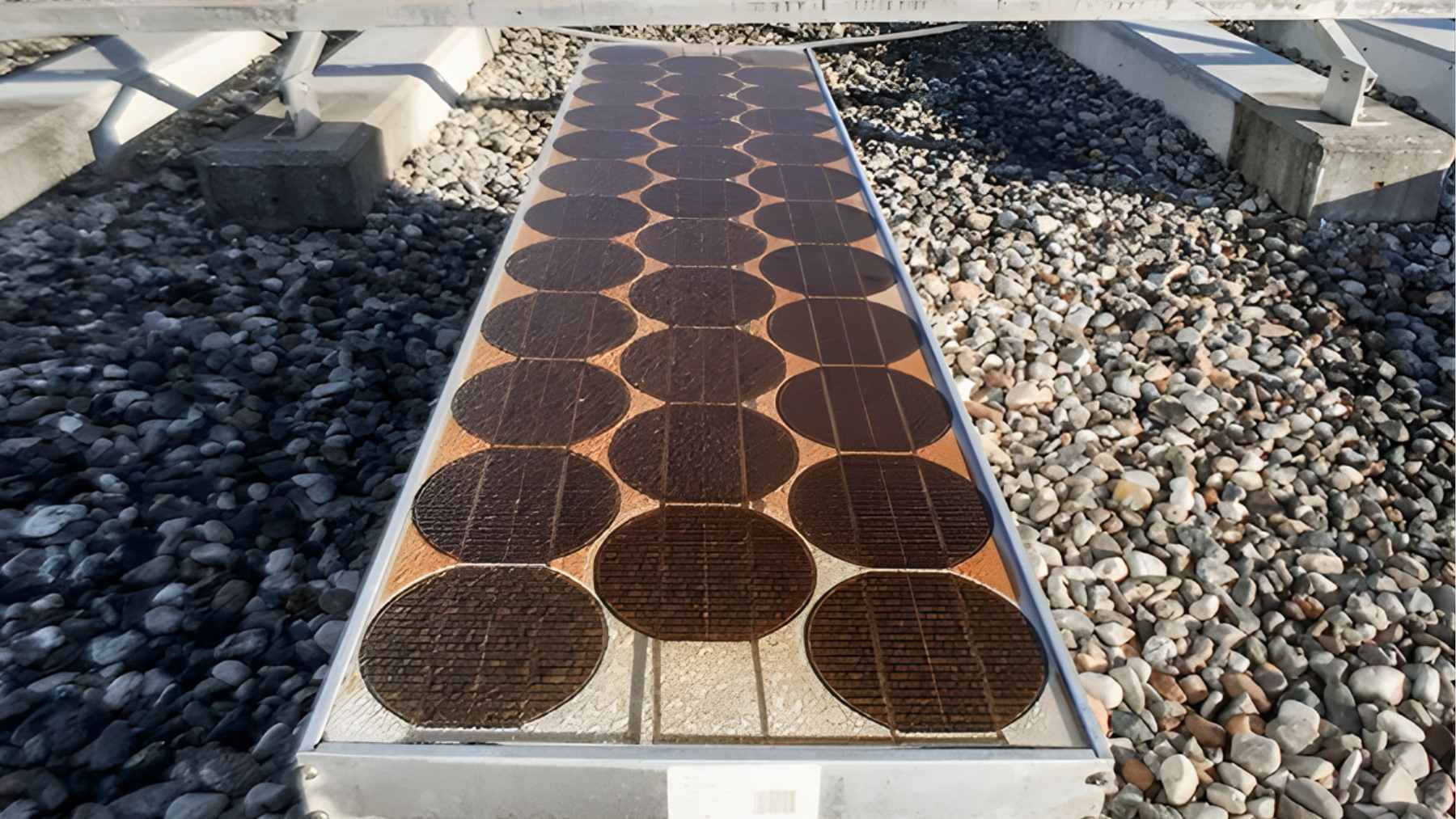

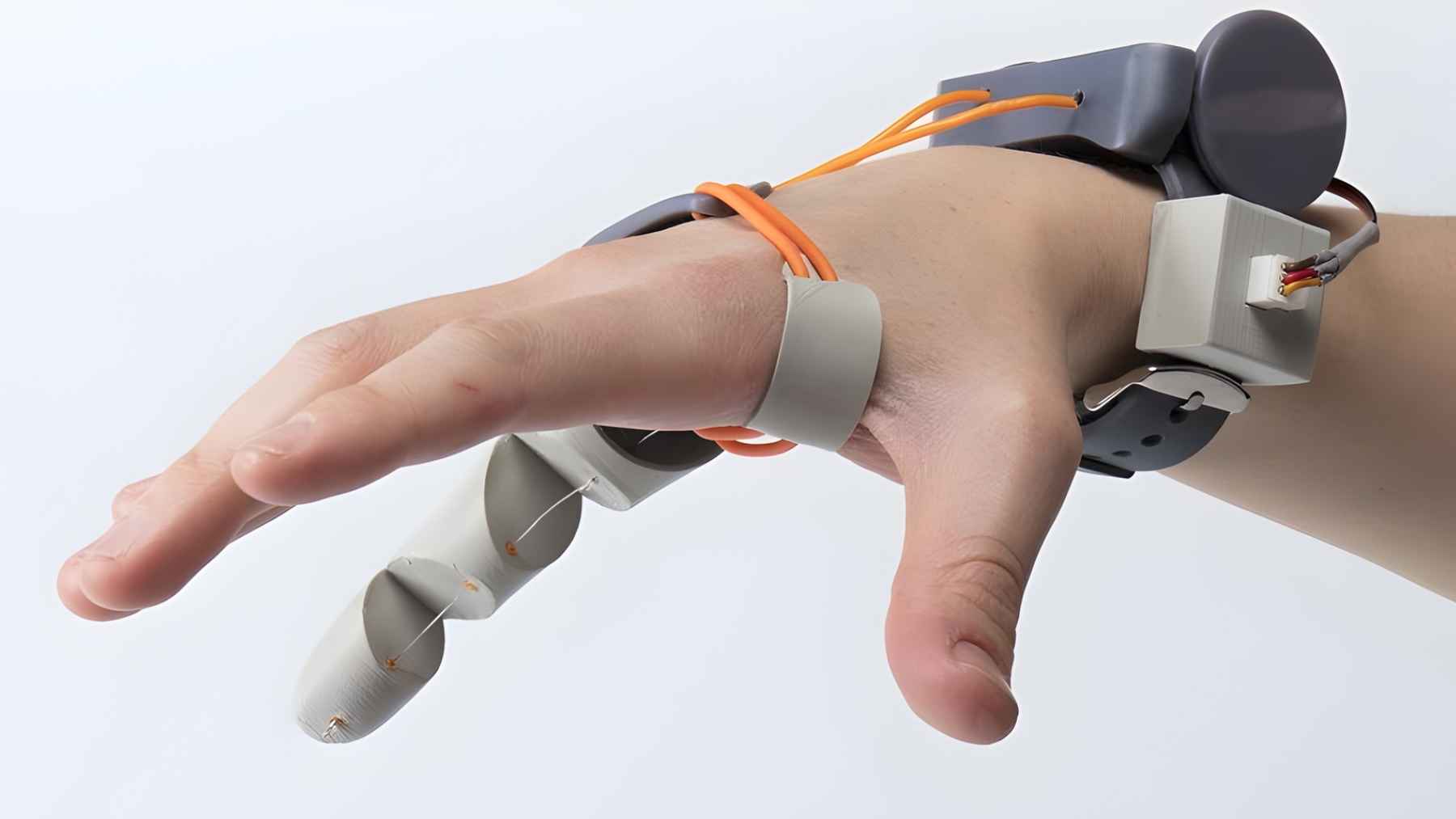

Thanks to clean energy tax credits, many homes saved when upgrading their HVAC systems, weatherizing their homes, and installing solar panels. Sustainable living was a possibility for many American families who saw a large reduction in terms of upfront costs.

While many Americans were of the opinion that there would still be time to go down the clean energy pathway thanks to these energy credits, HR1 came in to cut the timeline shorter. Initially, these energy credits were set to be in existence until 2032. According to new legislation, most energy credits are now ending by December 31, 2025, and some may have already ended.

Families may thus lose out on these particular energy credits if they don’t take action immediately:

- Energy Efficient Home Improvement Credit: This credit ends December 31, 2025, and is worth $3,200 per year for all qualifying improvements.

- EV Purchase Credit: The offer of up to $7,500 for new EVs and about $4,000 for old EVs has now already ended as of September 30, 2025.

- EV Changing Credit: By June 30, 2026, the 30% discount of home EV chargers will no longer be applicable.

- Residential Clean Energy Credit: Ends December 31, 2025 and offers 30% off the cost of solar panels, geothermal systems, and battery storage.

For homeowners looking to upgrade their homes, such energy tax credits offered somewhat of a relief in terms of easing off the initial hefty upfront costs. American families now fear dealing with higher costs should they opt for the same clean energy alternatives.

Many households cannot buy into clean energy upgrades

Many American homeowners who had been planning energy upgrades are already rather stressed about the time when all the energy credits vanish. The expiration of these credits will affect the working-class and middle-income families the most. The fear is that the cost of a high-efficiency heat pump can cost anywhere between $15,000 and $30,000 to install. Up until now, families could claim a $2,000 credit each year to offset the costs. With the reality of the high cost with no tax credits on offer, few families can switch to a high-efficiency heat pump.

The large-scale implication of saying goodbye to tax breaks as energy credits vanish is that many families won’t be supportive of even smaller upgrades. Communities and sustainable efforts are ultimately affected.

Some actions to take before the first consequences hit

Should homeowners wish to take action before energy credits vanish completely, there is still some time to make a few sustainable changes:

- Opt for an energy audit of your home so as to identify cost-effective upgrades.

- Install EV chargers, if possible, prior to June 2026 to avoid missing the deadline.

- Claim for any tax credits when filing your IRS Form.

Since the cost to buy a brand new or a used EV has already increased, homeowners in America can only imagine what will happen when the 30% tax break ends in 2025.

The sun is setting on the tax break you deserve

As per the IRS official statement on Energy Efficient Home Improvement Credit, HR1 has now been passed into law, and for many, the consequences are becoming more clear. The implications of making tax credits vanish is that the affordability of clean energy options becomes sticky, but also climate goals have to be somewhat put on pause for many. There is still time for Americans to act before the sun fully sets on clean energy credits. There is still, however, a chance for your battery to pay you back via utility programs.

Disclaimer: This article is for informational purposes only and does not constitute tax advice. It does not replace IRS guidance or official notices. To confirm your eligibility or payment status, click the IRS‑linked resources in our article or log in to your IRS online account; for personalized advice, consult a qualified tax professional.