At first glance, Searles Lake is just an immense white plain, marked by salt and the relentless sun. But beneath its arid surface lies one of the world’s richest and most strategic mineral deposits. For over a century, the lake was mined for borax, soda ash, and other salts that have sustained everything from the glass industry to agricultural fertilizers. Now, in the midst of a race for critical minerals for the energy transition, Searles Lake is once again in the spotlight. The reason is a staggering number that could redefine the future of energy: 2 million tons. What exactly this number represents, we’ll explore below.

Searles Lake fuels both a town’s history and the world’s energy future

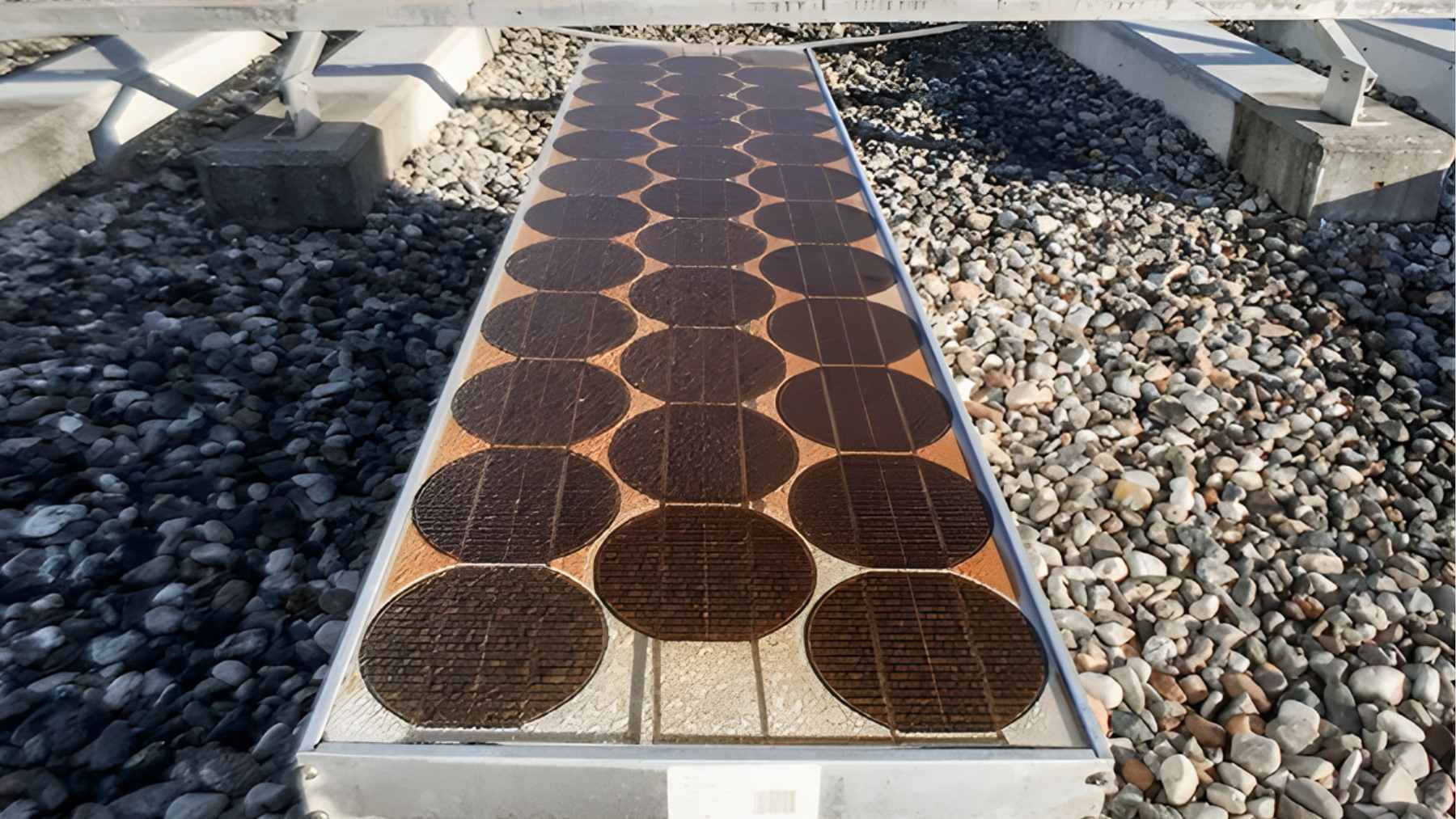

We must keep in mind that Searles Lake is not just a geological relic; it is also an economic engine. This is because its history dates back to the 19th century, when John Searles discovered borax deposits on the lake’s surface. Today, mining continues on a large scale, but unlike the mules that transported borax in the 19th century, what drives Searles Lake now are wells, solar ponds, and sophisticated chemical processes.

This industrial landscape is part of something larger: an annual production capacity that reaches impressive numbers. Here’s the revelation: Searles Lake can process approximately 2 million tons per year, much of it dedicated to sodium-based chemicals. This volume is not just an industrial statistic; it is the key to understanding how sodium can change the global energy game.

Lithium’s reign is fading, and sodium is ready to take the throne

It’s worth remembering that in recent years, lithium has become the “white gold” (albeit different from volcanic white gold, which is below this stage) of the energy transition. This is because it’s found in almost all electric car and mobile device batteries. But this reign faces serious challenges: costs remain high, reserves are concentrated in a few countries, and the environmental impact of mining is increasingly criticized.

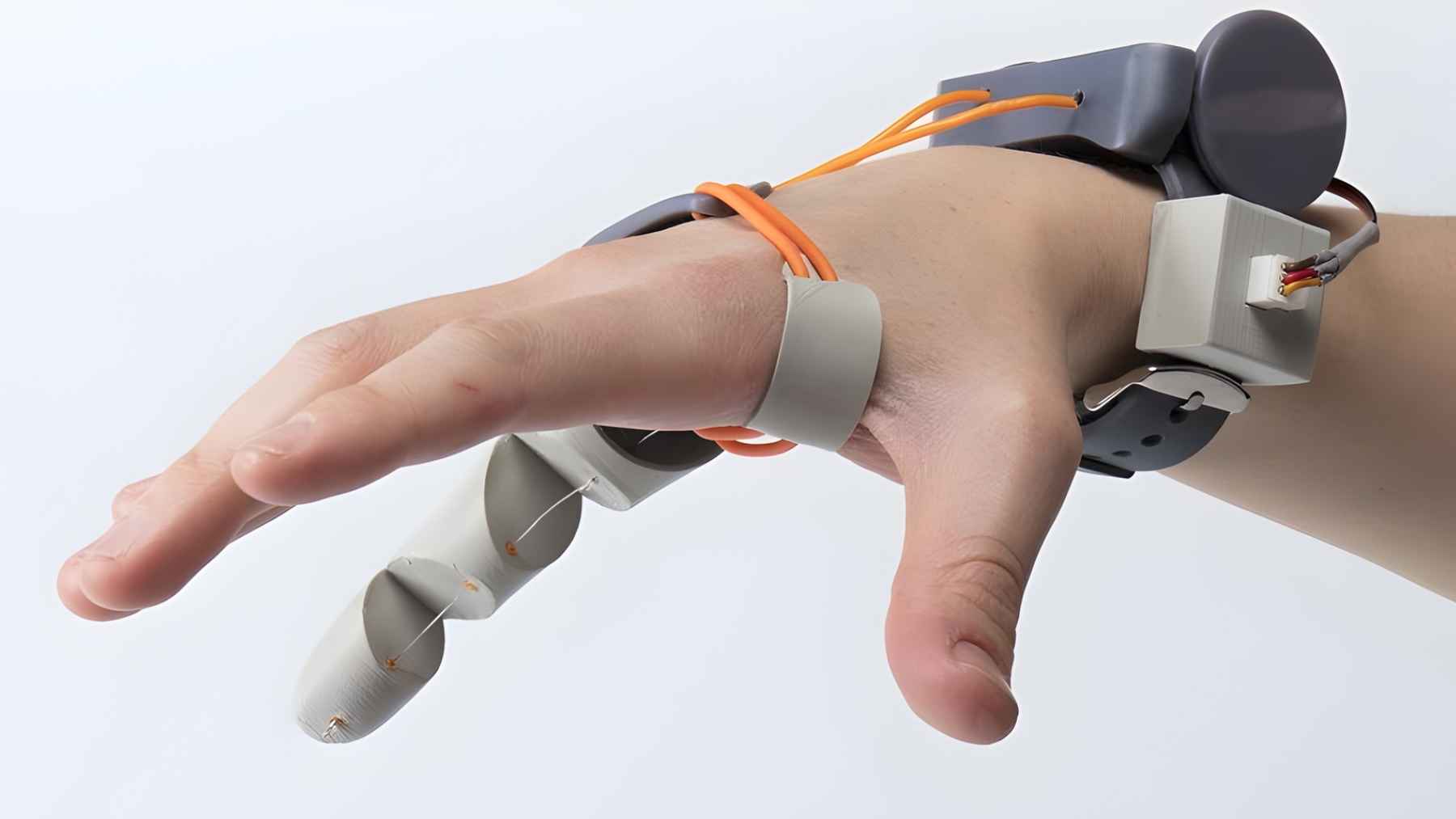

However, if the future depends solely on lithium, we’ll face a problem of scale. After all, global electrification demands more than Earth can provide affordably and sustainably. And this is where sodium comes in; it’s abundant, cheap, and much less dependent on unstable geopolitical conditions. What was once only a component of detergents, glass, and paper is now beginning to be seen as a candidate to replace lithium in new-generation batteries.

Researchers and companies are already testing sodium-ion batteries, which, while still having a lower energy density, offer advantages in cost, sustainability, and availability. And when we look at a lake that alone provides millions of tons of sodium compounds every year, the potential becomes clear. Some of its main applications are:

- Soda ash: essential in the production of glass, detergents, and paper.

- Chemical processes and water treatment: already established industrial applications.

- Sodium-ion batteries: a bet to replace or complement lithium in the energy transition.

From pink lakes to global factories

The lake’s beauty also tells a part of this story, largely due to the saline lagoons tinged pink by halobacteria and the halite crystals that have become visual icons. But behind this almost alien aesthetic lies a supply chain that connects the Californian desert to the entire world.

The minerals extracted from Searles Lake supply everything from agriculture to the technology industry. Soda ash production, in particular, is so stable that it has become a pillar of global manufacturing. And this predictability may be sodium’s greatest advantage. After all, with ample reserves and well-established extraction processes, it offers a steady supply that can sustain industries without the same uncertainties as lithium. For economies seeking stability in the energy transition, this is gold, or rather, salt. Yes, it seems the future is sodium; no wonder I’m already fearing the 22nd-century battery.

Disclaimer: Our coverage of events affecting companies is purely informative and descriptive. Under no circumstances does it seek to promote an opinion or create a trend, nor can it be taken as investment advice or a recommendation of any kind.