Residents of the state of Colorado can expect significant tax rebates if they apply by the end of December. The Property Tax, Rent, and Heat (PTC) Rebate program is intended for low income elderly or disabled individuals. The program helps eligible beneficiaries cover their property tax, rent, an heat for the upcoming winter and into the rest of 2025. This year, rebates are calculated based on 2023’s taxes.

The program targets low-income individuals and households

To be eligible to participate in the program, you must be a Colorado resident make an annual income of less than $18,026 a year. Married couples who are filing jointly must not have a combined income exceeding $24,345. Participating individuals must be over the age of 65 as of December 2023 or surviving spouses must be at least 58 years old a of December 2023.

If you are a surviving spouse, you must have been married to your partner before their decease. Disabled individuals can qualify for the program at any age. However, they must have been eligible to receive full disability benefits for the entirety of 2023 to qualify this year. To be eligible to receive disability benefits, your disability must limit your ability to earn an income.

Further requirements to receive rebates from 2023 taxes include property taxes, rent, and heating costs

If you meet the income, age, or disability criteria to receive rebates from 2023, there are additional requirements you must fill. You must have paid property tax, rent or heating bills during the 2023 year. Further, you must not have been claimed as a dependent on someone else’s federal tax returns. If you have been participating in the program for the last two years, you can fill in the application electronically in the Revenue Online service.

If this is your first time participating in the program and claiming rebates for the 2023 year, you must mail your application to the following address:

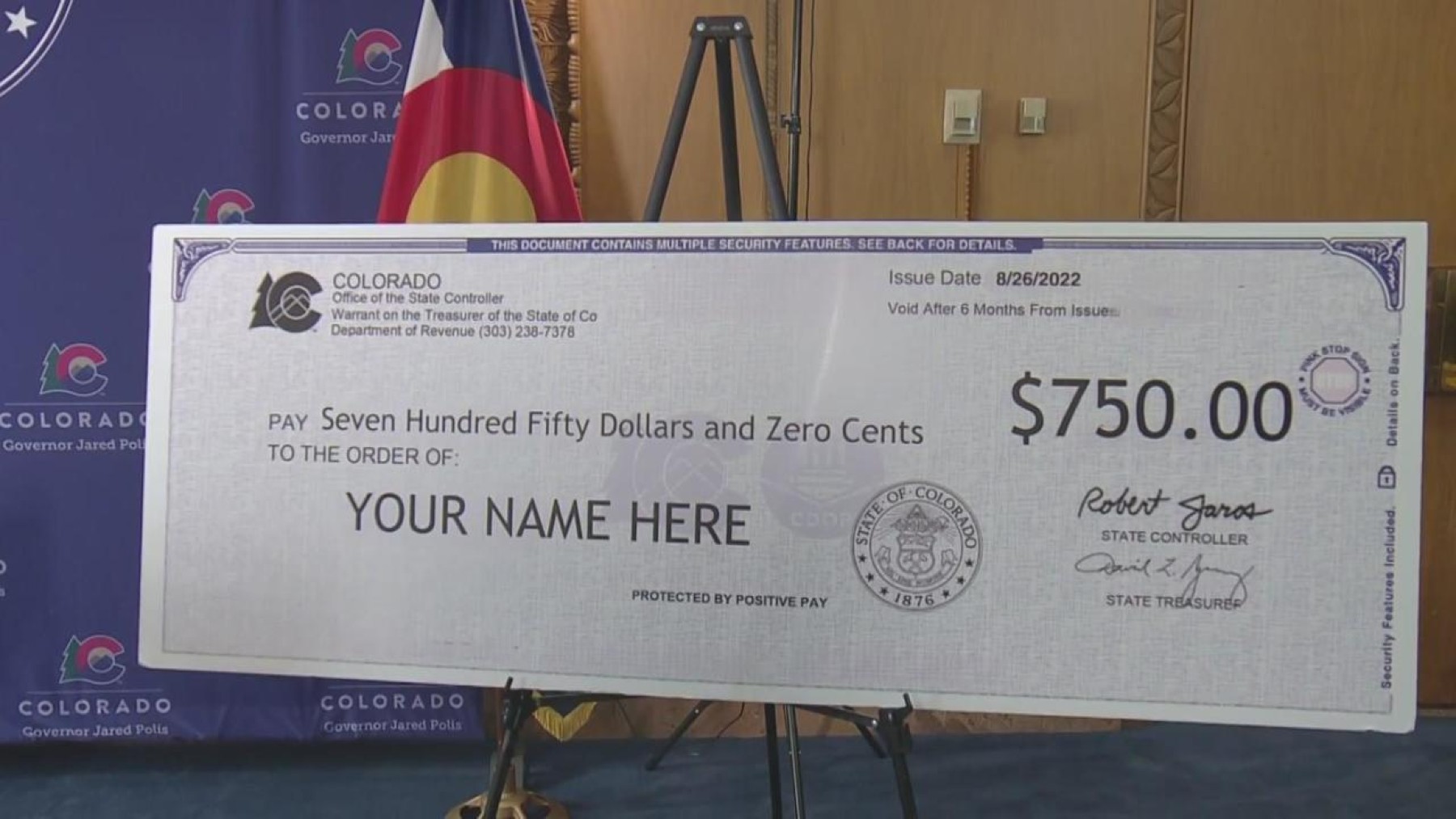

Payments are released depending on when you submitted your application

The total rebate amount will see residents receiving up to $1,112 dollars. If you applied by April 2024, this amount increased to $1,600. Applications ae still currently open to claim back for the 2022 year. for 2021 and years prior, the deadlines have passed to receive tax rebates, Individuals who do not possess a social security number are also still eligible to receive rebates.

Colorado has a high cost of living compared to the national average coming in at a $53,374 average per year. The state ranks 35th in terms of cost of living. Housing costs are 20% higher than the national average, but utility costs are 9% lower. The state has a flat income tax for all residents at 4.4%. The program is a significant asset to low-income Colorado residents and has been a major implementation success.