If you have ever watched the mailbox for a check, you know the odd mix of hope and worry that comes with it. This fall, millions of Social Security recipients were told that era was ending. A government push to move everyone to direct deposit or a prepaid card reached a deadline on September 30, 2025, and for weeks the message sounded absolute.

Then, with the deadline in the rearview mirror, the agency added an important caveat. It clarified that people who cannot use electronic payments will still receive paper checks. This ensures that no one will miss a benefit simply because they could not switch in time.

For seniors and disabled Americans juggling rent, medicine, and groceries, that detail matters more than any press release.

What changed after the September 30 deadline?

The White House issued an executive order on March 25, 2025 that told agencies to stop issuing paper checks for federal payments by September 30, 2025, to the extent permitted by law. The goal was straightforward in government terms: make payments safer, faster, and cheaper by using electronic funds transfer, known as EFT, which includes direct deposit and cards like Direct Express.

As often happens with big bureaucratic shifts, the rule had exceptions baked in for cases where electronic payments are not feasible.

In the days before the deadline, Social Security posted guidance that added reassurance. The agency said that if someone has no other way to receive a benefit, it “will continue to issue paper checks” and that there were “no plans to pause any payments starting October 1.” Translation for everyday life: your monthly payment will still go out, even if you could not get set up online in time.

An SSA official also discussed the transition at a Treasury‑hosted Financial Literacy and Education Commission meeting that week, underscoring that agencies were working through real‑world constraints while implementing the order.

Why did the government push to end paper checks in the first place?

Officials point to security and cost. Treasury says paper checks have historically been 16 times more likely to be reported lost or stolen compared with electronic transfers. The executive order also cites broader risks like mail theft and delay, and it frames electronic payments as a way to cut fraud and administrative overhead. If you have ever had a check misdelivered, you can see the appeal of money landing in your account without a postal detour.

There is also the nuts‑and‑bolts math. Moving money electronically costs less per payment than printing and mailing a check. According to the information you provided, agencies estimate a paper check costs about 50 cents to issue while an electronic transfer costs about 15 cents. With tens of millions of payments a month, those nickels add up fast, which is about as exciting as government savings get.

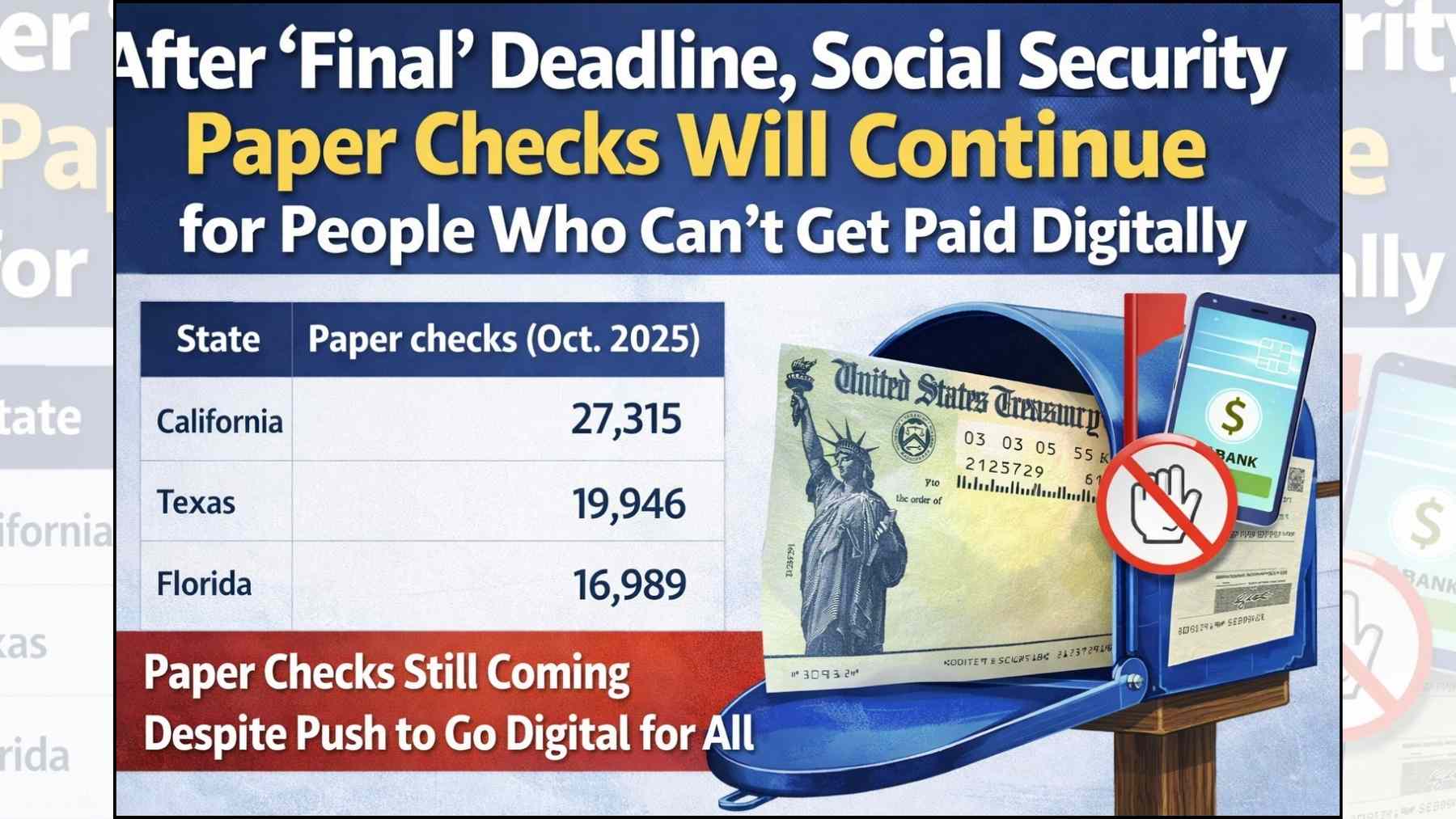

How many people still get paper checks, and where?

Most beneficiaries already use electronic payments. In October 2025, SSA reports that 99.5 percent of roughly 69.6 million Social Security payments went out electronically. Still, hundreds of thousands of checks were mailed, and some states have more paper users than others.

Here is where mailed Social Security checks remain most common among the three largest states:

| State | Paper checks (Oct. 2025) |

| California | 33,909 |

| Texas | 23,409 |

| Florida | 20,545 |

These counts come directly from SSA’s monthly table. The agency’s data also show that electronic participation is above 99 percent in every state, which is a high bar in any nationwide program.

Is Social Security really ending all paper checks?

Not entirely. The policy is to pay benefits electronically by default, but SSA has now said in plain language that it will keep issuing paper checks when a person has no other way to receive payment. That includes people without access to banking or to the internet.

The agency’s September 19 update put it this way: “If you have no other way to receive payments, we will continue to issue paper checks. There are no plans to pause any payments starting October 1.”

Advocates warn that one‑size policies can leave people behind. Nancy Altman of Social Security Works argued that eliminating checks could harm disadvantaged Americans who lack the money to open or maintain bank accounts and who rely on cashing a check immediately to cover basics like food and shelter. Her point is simple and practical, and it echoes what field offices see every day.

How do you switch to electronic payments right now?

If you can go digital, here are your official options. The steps are straightforward, and yes, they are designed to avoid waiting for the mail.

- Direct deposit to a bank or credit union. If you receive Social Security retirement, survivors, or disability benefits, you can manage direct deposit through your my Social Security account at ssa.gov. SSI recipients and international beneficiaries can call 1‑800‑772‑1213 for help.

- Direct Express debit card. If you do not have a bank account, you can enroll by calling 1‑800‑333‑1795 or by visiting usdirectexpress.com. This prepaid card is sponsored by Treasury for federal benefits.

- Waiver request if electronic payment is not possible. If you truly cannot use electronic methods, you can ask U.S. Treasury for an exemption by calling 1‑877‑874‑6347. This is the Electronic Payment Solution Center referenced in SSA’s transition materials.

If you are still getting a paper check, SSA also says it has been mailing inserts with step‑by‑step instructions, and staff continue to contact beneficiaries by phone, mail, and email to help with the switch. Think of it as a slow‑motion nudge rather than a hard cutoff.

What if you truly cannot use electronic payments?

The executive order itself allows exceptions where EFT is not feasible. Treasury’s rules under 31 CFR Part 208 say federal payments must go electronically unless a waiver applies, and SSA’s guidance points people who need an exemption to Treasury’s helpline. In practical terms, this means “there is a process if you need it,” and it keeps the program accessible in rural areas and other places where banking is limited.

SSA also made clear that benefits will continue during this transition. In its September 19 post, the agency emphasized there were no plans to pause payments, which should reduce anxiety for people who depend on these funds to keep the lights on. If you remember the first Social Security paper check back in 1940 was mailed to Ida May Fuller in Vermont, it is fitting that paper still exists as a backstop 85 years later.

Why this matters for you

Getting benefits by direct deposit or Direct Express cuts the chance of theft and delays, and it avoids check‑cashing fees. Treasury has publicly noted the theft risk with paper, and SSA’s data show near‑universal electronic adoption already. If you use a bank account, you also gain quicker access to funds, which in plain English means paying rent on time without a trip to the check‑cashing counter.

On the other hand, not everyone can bank online or at all. That is why the waiver exists and why SSA said paper checks will remain for people who have no other option. It is also why advocates like Altman pressed the point that policies must work for people with the fewest resources, not only for those who are already plugged in.