This stimulus hits just in time for last-minute Halloween and holiday shopping. Local governments across the country have been underway with sending out their own unique stimulus payments for eligible recipients. As the holiday season fast approaches, kicking off with Halloween, many individuals would, at this time, gladly welcome a stimulus payment in order to cover the associated increased expenses during this period. Additionally, there are talks of new federal stimulus payments to be released soon.

This stimulus check hits just in time for the holiday season

The backend of the year brings in the nation-favourite holidays, namely Halloween, Thanksgiving, and Christmas. However, also means that increased expenses make themselves known, such as travel costs and presents for family. As such, a once-off stimulus payment would give individuals a welcome boost to assist in covering these new costs.

At a local level, multiple states are underway with distributing their own unique stimulus payments. Generally, stimulus payments are one-off payments that are distributed to residents based on an identified economic crisis or need. Other stimulus payments are associated with tax rebates, whereby residents are provided tax relief through these once-off payments.

One of the most well-known examples of stimulus payments associated with tax rebates pertains to property tax rebates. Many states offer their residents property tax rebate stimulus payments, as these programs can disproportionally affect low-income and other economically vulnerable residents. While property taxes assist in funding local essential services, they may also widen socioeconomic gaps.

Well-known examples of property tax rebate programs that are currently underway include the New York School Tax Relief (STAR) program and neighbouring state New Jersey’s Affordable New Jersey Communities for Homeowners and Renters (ANCHOR) program. These programs are often limited to low-income property owners and renters in order to reduce their overall state tax liability to strive for a more equitable tax-paying landscape.

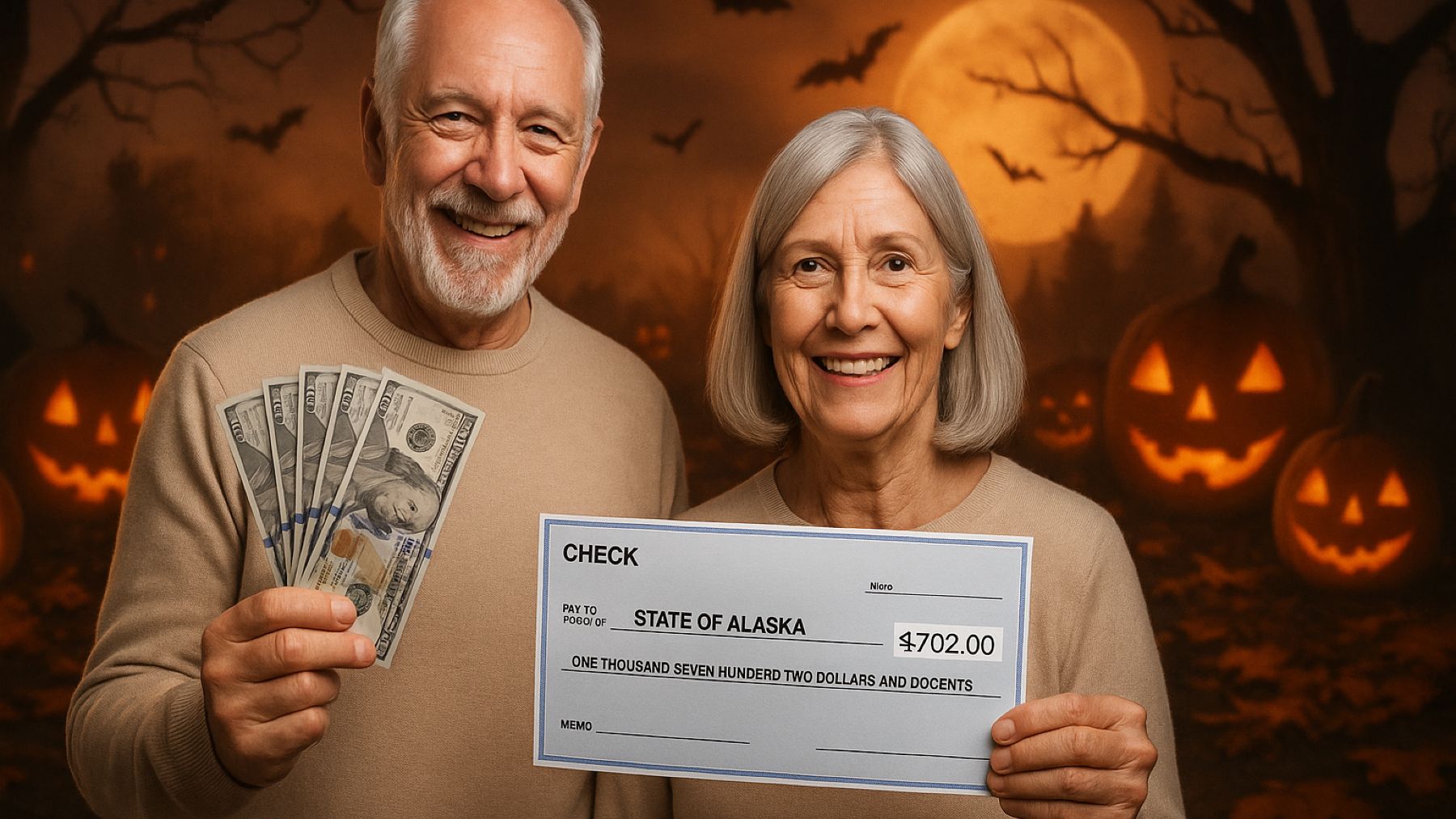

Claim your stimulus payment in Alaska towards the end of October

Further North, this stimulus hits just in time for Alaskan residents from the Alaska Department of Revenue through the state’s Permanent Fund Dividend (PFD). This stimulus payment is an annual payment made to Alaskan residents in order to allow residents to share in the state’s mineral and oil profits.

To qualify for the payment, residents must meet the following eligibility criteria:

- You must be a resident of Alaska for at least one year before applying.

- You may not have been out of the state for longer than 180 days, with exceptions such as serving in the military or being out of state for college.

- Specific limitations on your criminal record.

This year’s PFD stimulus payment amounts to $1,702. Residents whose application read as ‘Eligible-Not paid” by October 13, 2025, will see their stimulus payment paid out by October 23, 2025.

Keep informed on more upcoming stimulus payments

If you are not a resident of Alaska, you may still qualify for a once-off stimulus payment. At a local level, two stimulus payments, which will be distributed this month, include a once-off stimulus rebate by the Virginian authorities due to the state encountering a tax surplus, as well as the continued Family First Economic Support Pilot Program (FFESPP) in California. The FFESPP is investigating the feasibility of a basic guaranteed income program for low-income California residents.

On top of these local stimulus payments, the federal government is currently debating a proposed piece of legislation, dubbed the American Workers’ Rebates Act, which intends to provide one-off stimulus payments to eligible residents and allow residents to share in the revenue generated from the new tariff policies introduced by the Trump Administration. The act was introduced in July of this year and is still waiting to be passed or not by the Senate.

Disclaimer: Our coverage of stimulus checks, tax reliefs, tax rebates, tax credits, and other payments is based on the official sources listed in the article. All payment amounts and dates, as well as eligibility requirements, are subject to change by the governing institutions. Always consult the official source we provide to stay up to date and obtain information for your decision-making.