The Federal Reserve has lowered interest rates again, trimming its key rate by a quarter of a point in mid‑December. The federal funds target range now sits around 3.5% to 3.75% after three cuts this year. Investors welcomed cheaper money, but retirees who rely on Social Security are wondering what it will do to next year’s check.

Social Security benefits rise once a year through the cost-of-living adjustment, or COLA, which is designed to track everyday price changes. The COLA for 2026 is already locked in at 2.8%, a bit higher than the 2.5% boost that arrived in 2025. The big question now is whether lower interest rates and easing inflation will translate into a smaller COLA in 2027.

How Social Security COLA Works

Each fall, the Social Security Administration calculates the COLA using an inflation yardstick called the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI‑W. This index tracks how much a fixed basket of goods and services costs compared with a year earlier. When that index climbs, the agency raises benefits by roughly the same percentage so buying power does not quietly shrink.

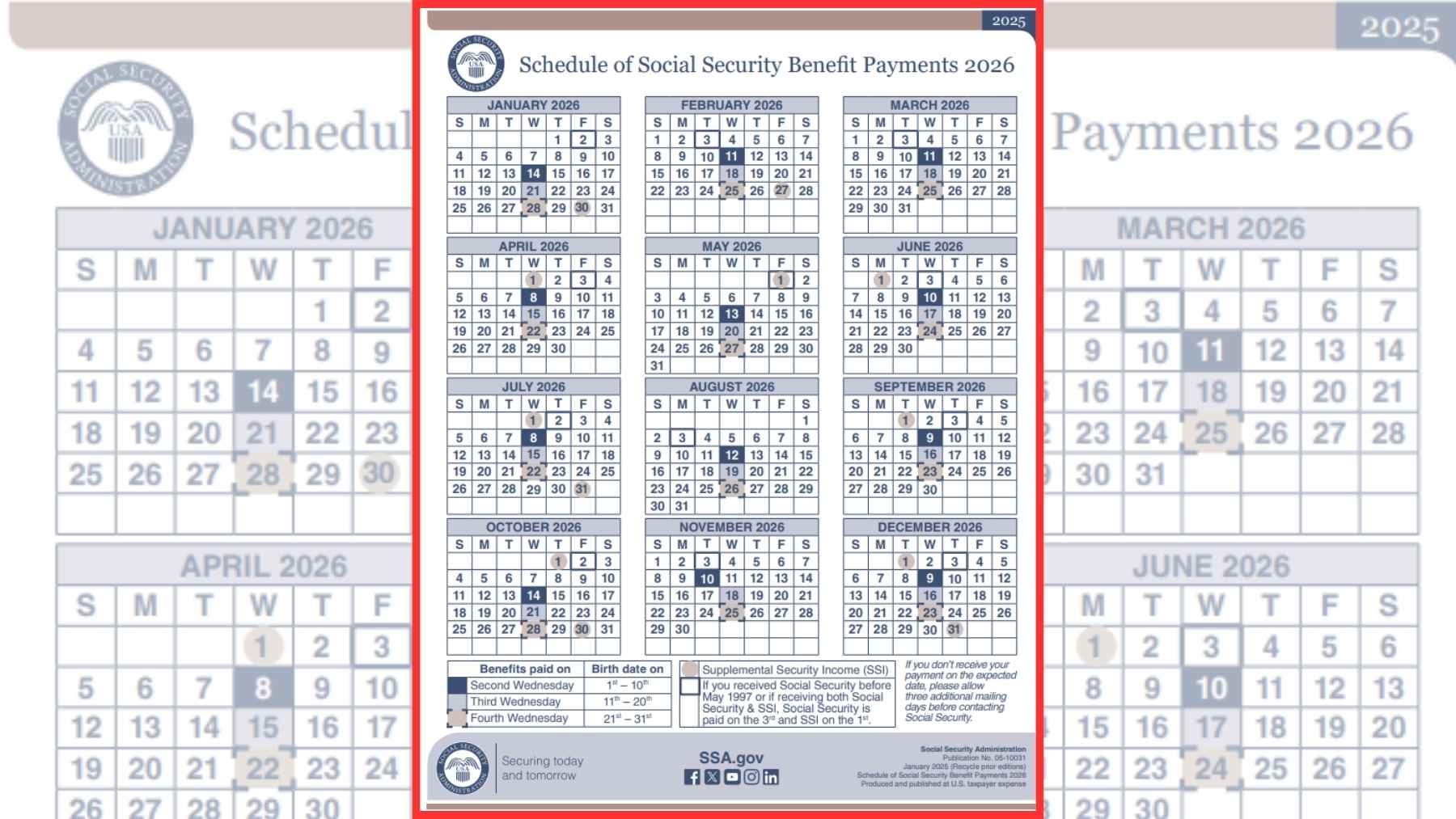

For the 2026 COLA, officials compared average CPI‑W readings from July, August, and September 2025 with the same three months in 2024. That formula produced the 2.8% increase that will reach nearly 71 million Social Security and Supplemental Security Income beneficiaries starting in January.With an average monthly retirement benefit of about $2,010 as of September 2025, that works out to roughly $60 extra before Medicare premiums or taxes.

Financial analysts note that this new increase caps five years of unusually strong COLAs that followed the pandemic surge in prices. The adjustments from 2022 through 2026 average more than 4.5% a year, the highest five‑year stretch in roughly four decades. Yet many retirees say their rent, medical bills, and grocery runs still feel one step ahead of their monthly deposits.

What The Fed’s Rate Cuts Are Telling Us

The Federal Reserve says its recent cuts are meant to support economic growth while still nudging inflation back toward its 2% goal. Lower borrowing costs can help households refinance mortgages, buy cars, or pay down credit card balances, easing some monthly strain. The trade‑off is that savers in certificates of deposit, savings accounts, or money‑market funds may see the interest they earn start to slip.

For Social Security, the effect of these moves is indirect and shows up mainly through inflation. If cheaper money keeps demand strong, businesses may find it easier to raise prices for goods and services. On the other hand, the Fed’s latest projections still show inflation gradually cooling rather than returning to the spikes seen earlier in the decade.

Inflation Trend And The 2027 COLA

Recent figures from the Bureau of Labor Statistics show consumer prices up about 3.0% over the year through September and 2.7% over the year through November. That is far below the peaks above 8% seen in 2022, but it still means the grocery cart, rent payment, and electric bill cost more than they did a year ago. For older households on fixed incomes, shelter, medical care, and energy remain especially heavy line items.

The 2025 federal government shutdown also interrupted the usual flow of data by halting October price collection. There was no standard October CPI news release, and statisticians had to carry forward earlier prices and explain the gap to users of the data. For anyone watching the COLA outlook month by month, that missing report made the inflation picture a little fuzzier.

Even so, the broader direction looks clearer in official forecasts.The Fed expects its preferred inflation gauge to end 2025 near 2.9%, ease to about 2.4% in 2026, and move toward 2.1% in 2027, while a separate Survey of Professional Forecasters points to a similar cooling pattern. If prices follow that path, many analysts think the 2027 COLA will probably land somewhere in the low‑to‑mid 2% range, though the final number will depend entirely on CPI‑W readings from July through September 2026.

How Retirees Can Prepare Now

In dollar terms, a 2.8% COLA adds around $60 a month to the average retirement benefit before Medicare premiums and other deductions. Some of that raise will likely be absorbed by higher health‑care costs and rising premiums, which can blunt how much of the increase actually shows up in a retiree’s wallet. For many households, the real‑world bump may feel modest once those new bills land in the mailbox.

So what can retirees do while they wait for the 2027 numbers. One step is to treat Social Security as a foundation rather than a complete income plan and use savings, part‑time work, or trimming nonessential spending to fill any gap left by a 2% to 3% COLA. It also helps to follow monthly inflation releases and Federal Reserve meetings for clues about where future COLAs might land, but the main official press release on the 2026 cost of living adjustment has already been published by the Social Security Administration.