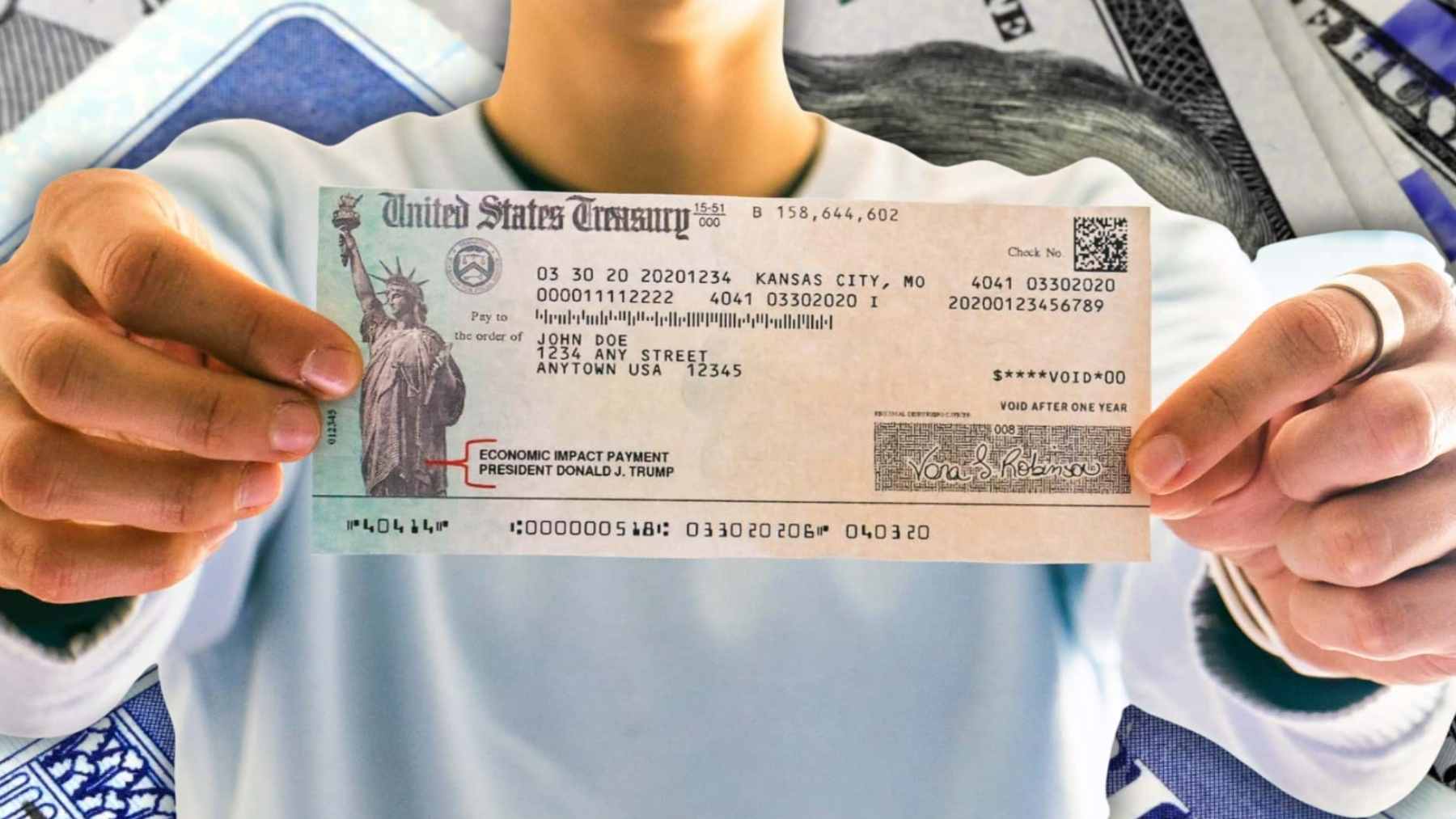

The IRS has just issued a warning to millions of Americans, possibly including you. Do not expect an SMS or a letter, because time is running out to receive the stimulus checks that have been pending for months. The amount is more than you can imagine: unclaimed 1 billion that could now go back to the Public Treasure if you don’t ask for them in time… and it’s running out.

There is $1 billion in unclaimed stimulus checks: IRS has confirmed

Due to the circumstances you already know, the extent of government support for striving citizens economically became clear due to frenzied stimulus efforts to cater to their needs. One of the biggest recent events in the US economy is stimulus checks, tax credits, and other relief payments given to Americans since 2020.

And now, as an example in 2024, there already almost $1 billion getting unclaimed from stimulus checks and tax credits. The unclaimed funds come from several COVID stimulus programs at the times 2020, 2021, and 2022. This is inclusive of the EIP furnished at the beginning of CARES Act.

There were several payments and checks that were send over a period of time. As a result, through a great number of rounds, Americans paid little attention or missed some of the funds that they were eligible for. The deadline is coming up soon, and there are only a few hours left for you to recover the money owed to you.

The deadline is approaching: last hours to get back the money

The elapsing of time for the Americans, who received the stimulus checks during the previous fiscal year due to the COVID-19 pandemic, is imminent. While today, May 17 is the final date to collect unclaimed Economic Impact Payments for those who are eligible, individuals are advised to promptly contact the nearest local office.

Once this time period is over, the additional unclaimed stimulus funds give back to US Treasury. In the opinion of the IRS, about 1 billion dollars missing turnover for the equitable tax system. Approximately 1 billion of stimulus checks and plus-up payments being received from 2021 is not claimed by the taxpayers so far.

The IRS is currently actively calling up and taking into explanation people who presume they have not received their stimulus payment redemptions. Taxpayers who do not have their stimulus funds and are wondering where they are will claim the funds when they file their 2021 federal income tax return.

The Internal Revenue Service can direct deposit taxpayers’ refunds with Recovery Rebate Credits now in as less as two weeks to those people who opted for direct deposit and opted for electronic filing of their taxes. After May 17th, the chances to get still unclaimed stimulus fund will be much narrower.

Are you eligible to get this unclaimed stimulus checks? That´s how you know

Out of the several million who qualify for the yet to claim stimulus fund. This encompasses populations that did not obtain all of the direct payments they were supposed to from the various COVID-related legislation acts. As we had done three rounds of stimulus checks distributed, we may have missed one or several payments.

The remaining ones may also claim from the COVID tax rebates package, namely Recovery Rebate Credit, Earned Income Tax Credit, or Child Tax Credit. Even those whom filing tax returns is not part of their regular activity could meet the criteria.

As you can see, these stimulus checks are going to be the most ambitious to date, even if we still have no news of the expected fourth payment. The idea, according to the IRS, is to solve the unclaimed 1 billion and distribute them to those who are entitled before the deadline runs out so that they can then continue with other social benefits that are on the table. Among them, you know which one is.