According to the One Big Beautiful Bill Act (OBBBA), a 30% tax break is available in 2025, and homeowners should ensure they take advantage of this tax credit before the end of the year. According to the Residential Clean Energy Credit, a 30% discount on the cost of battery storage systems is available until December 31, 2025. The International Revenue Services (IRS) has enforced harsher eligibility criteria, and waiting could result in missed deadlines.

The battery storage credit for batteries installed now

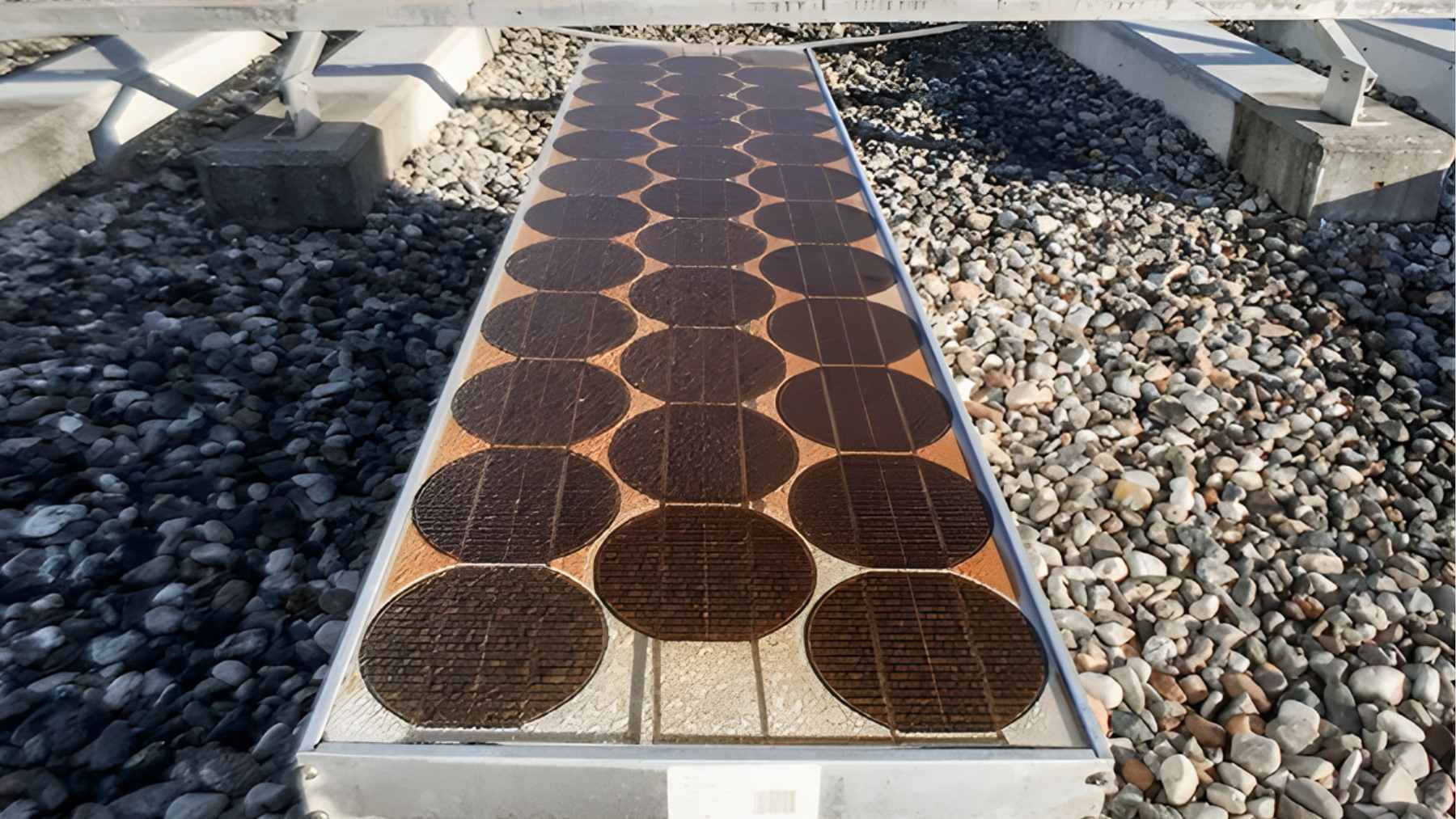

With the tax incentives soon to expire, the Residential Clean Energy Credit under Section 25D will become more pressing to get for many American homeowners. Thus far, up to 30% of the installation cost of battery storage and other clean energy systems is offered, especially when the installation is paired with solar solutions or installed as standalone backup systems.

News has broken out as of August 1, 2025, this will be the last year that this credit will be on offer. All citizens will still be eligible should the system be placed prior to December 31, 2025. Once December 31 arrives, all evidence of this credit disappears completely.

There are many advantages to making the most of this credit before it disappears. With battery storage systems, grid resilience is maintained in terms of outages that may have occurred. Energy even gets stored during the day at times when electricity prices tend to peak. Not only is this an economically feasible option, but the ideal solution for homeowners throughout the country.

The added pressure to install due to the Executive Order

According to the Executive Order signed on July 7 by President Donald Trump, termination dates were mentioned in the OBBBA legislation. The legislation clearly affects many households and businesses seeking a clean energy solution. According to the IRS, this tax credit will not be granted beyond the date of expiration, and thus, citizens need to make the deadline to qualify.

The clean energy contractors also face added pressure due to customers demanding the battery storage system prior to year-end. The overall demand for installations prior to the close of the year is expected to rise, and the high demand could result in delayed installations, which could cause some citizens to miss the deadline in place and miss this tax credit.

The main issue now faced is that of supply chain risk

The supply chain risk is another factor facing industries that are already experiencing logistical delays. With more consumers taking action to get clean batteries installed prior to December’s deadline, the demand has peaked, resulting in unprecedented backlogs in terms of battery manufacture.

The situation mimics that of the 2022 and 2023 rush for the solar battery system installations, which led to months of waiting time. Since the deadline for the 30% off has been set in stone, many installers may be taken aback by the growing demand for their products.

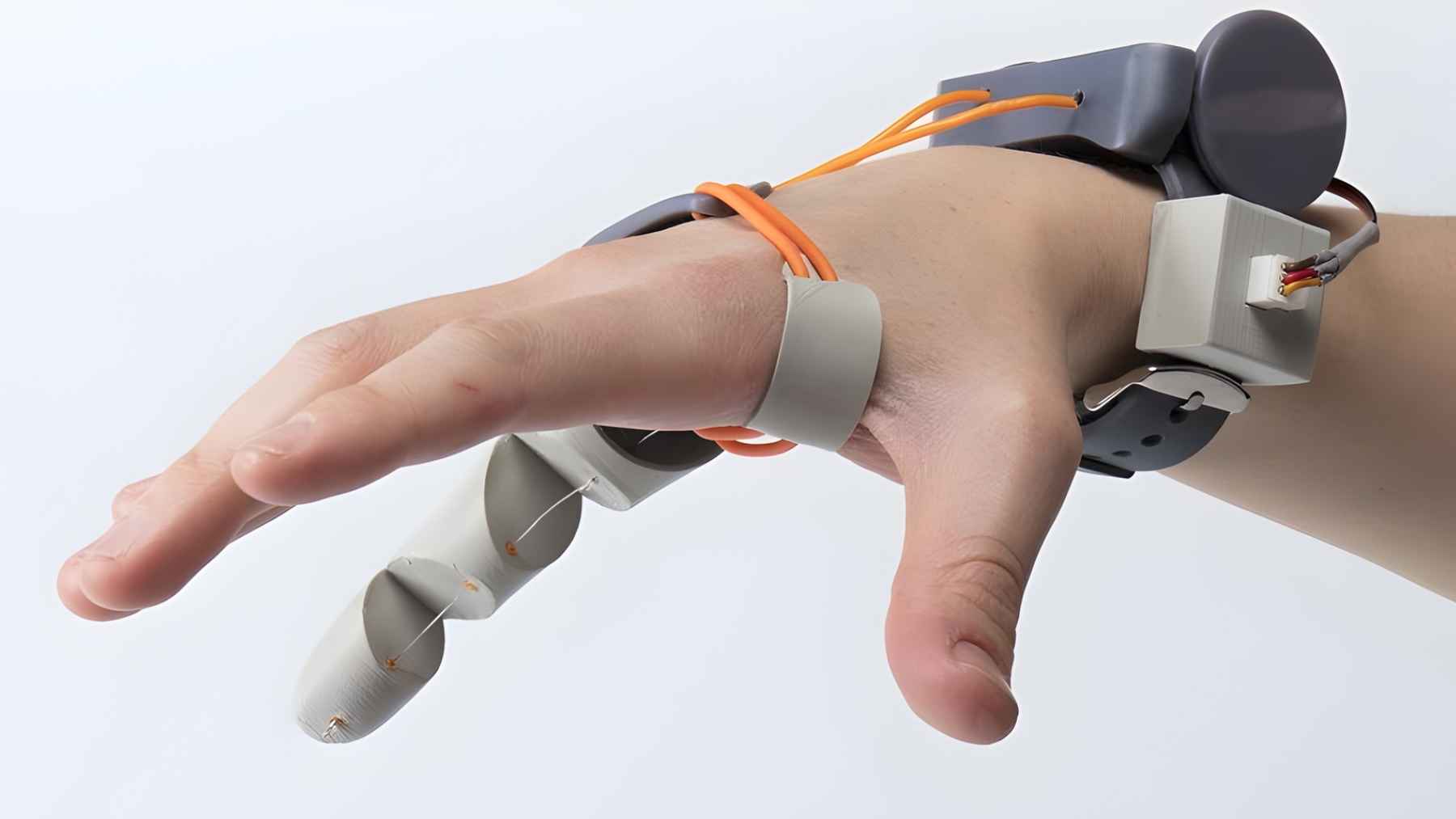

All customers eager who wish to install the battery storage system before the deadline sets should schedule and financially plan for the installation of this battery storage system from now on. Taking action earlier will ensure that your installation timelines are better and that you are spoilt for choice in terms of the system. Putting an end to all energy sources, a 5,000ºC battery has been unveiled, and it is no wonder why Americans are considering battery storage system solutions for a brighter and better future.

Allowing the savings to dictate your actions

An official statement from the IRS about the Residential Clean Energy Credit expiring in 2025 could signify a changing energy landscape. The 30% federal tax break on the line may cause owners to take action all at once and may delay battery storage installations.

While securing savings, homeowners can become more energy independent and save themselves from the ever increasing electricity prices. There is still a chance for citizens to take action and move towards better battery storage this year. With radioactive diamond-batteries lasting 5,000 years making headlines, its no wonder why everyone is considering battery storage system options.

Disclaimer: This article is for informational purposes only and does not constitute tax advice. It does not replace IRS guidance or official notices. To confirm your eligibility or payment status, click the IRS‑linked resources in our article or log in to your IRS online account; for personalized advice, consult a qualified tax professional.