President Donald Trump wants the United States to sell Venezuela’s oil. That much is clear from the recent US military operation in Venezuela and Washington’s push to take charge of the country’s crude exports, reported by CNN

But there is a basic question lurking behind the headlines. Who will actually need that oil in the years ahead? For years, China has been one of Venezuela’s biggest customers. Now its demand is starting to slip, not because of sanctions but because its energy system is changing at record speed.

A CNN analysis notes that about four to five hundred thousand barrels per day of Venezuelan oil currently flow to China, yet this is only a small slice of China’s total imports. Energy analysts at Rystad Energy add that any disruption from US actions would likely push Chinese refiners toward other discounted barrels from Iran or Russia.

In other words, Venezuela depends on China far more than China depends on Venezuela. That imbalance matters for both geopolitics and the climate.

A transport revolution on Chinese streets

The real story sits in Chinese driveways and traffic jams rather than in oil fields. According to data used by CNN from UK research firm Rho Motion, around 18.5 million electric vehicles were sold globally in 2025 and more than 11 million of those sales came from China alone.

That means more than half of the world’s new electric cars are now plugging into Chinese sockets instead of lining up at gas stations. By 2024, Rho Motion estimated that China’s EV sales were growing about 40% year on year, even as some Western markets stumbled.

Chinese climate expert Li Shuo describes this shift as “decisive” and not something that will swing back toward gasoline. Electric cars have become part of daily life there, from crowded megacities to smaller towns, rather than a niche product for wealthy early adopters.

If you picture your own commute, with tailpipes idling in a long line of cars, it is easy to see why this matters. Every car that runs on a battery instead of a tank trims oil demand and, over time, carbon emissions. Chinese analysts now argue that oil use in the country’s transport sector has already peaked, even though other sectors like aviation and petrochemicals still rely on fossil fuels.

Venezuela’s barrels and a shrinking market

For Venezuelan planners, the numbers are sobering. Rystad estimates that four to five hundred thousand daily barrels of Venezuelan crude head to China today, yet US intervention could shove that figure downward as refineries shift toward other suppliers.

At the same time, long-term projections suggest that China’s overall oil demand will level off and then decline, as electric cars, trains and heat pumps keep growing.

So while Washington treats Venezuelan heavy crude as a strategic prize, the biggest buyer is already planning for a future with less of it. To a large extent, that future is powered by renewables.

From petrostate to electrostate

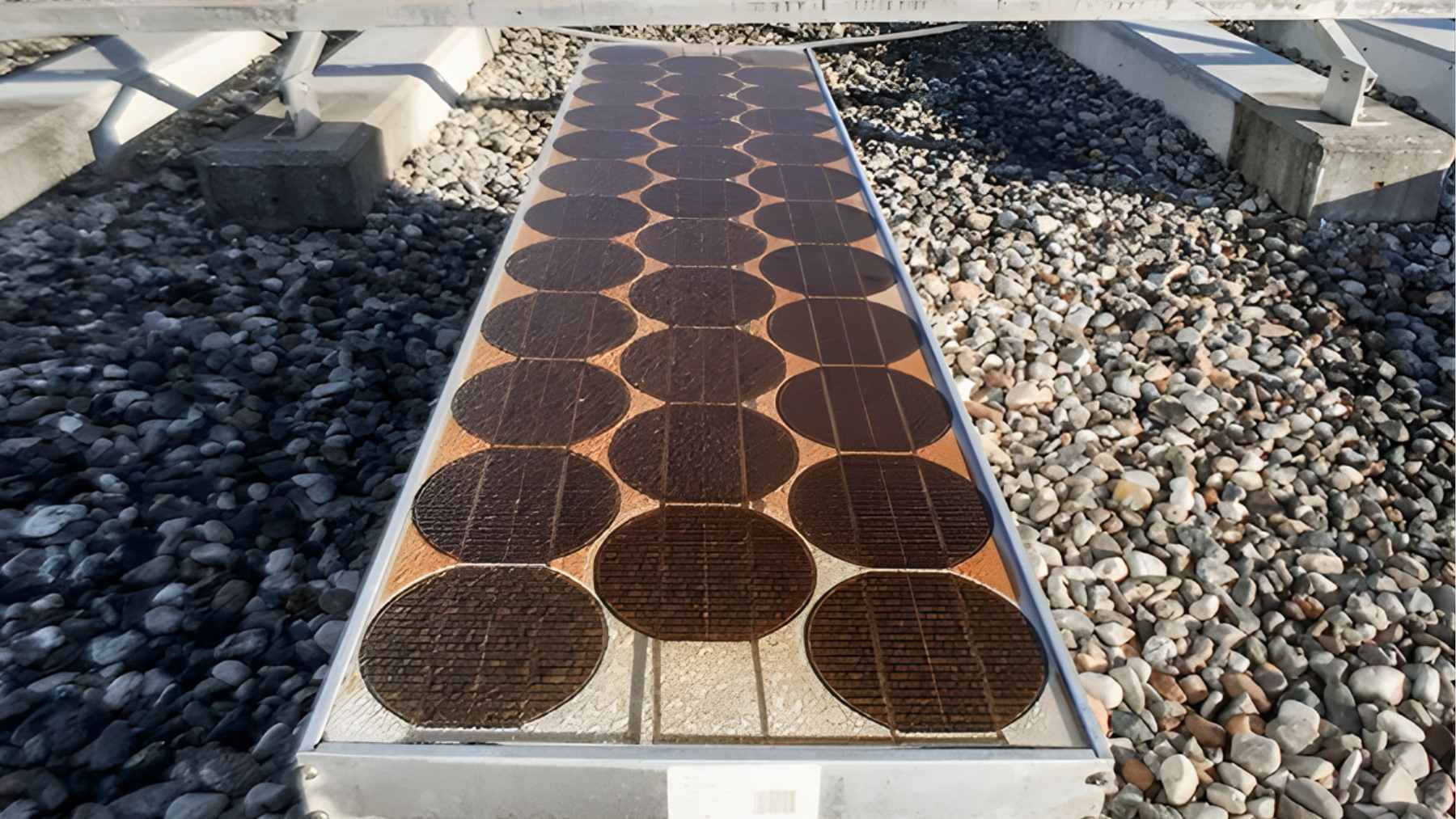

China is not only swapping engines for batteries. It is massively expanding its clean power system to keep those vehicles charged and factories running. Data from Global Energy Monitor show that the country is currently building about 510 gigawatts of large-scale solar and wind projects, on top of more than 1,400 gigawatts already operating. That buildout represents roughly three quarters of all such capacity under construction worldwide.

Beijing has also pledged to lift total installed wind and solar to around 3,600 gigawatts in the coming decade, which is roughly six times its capacity in 2020. On top of that, the country is expanding nuclear power and investing heavily in fusion research, hoping for an almost limitless source of clean energy later this century.

Some analysts now say China is becoming an “electrostate” rather than a petrostate, using electricity from renewables to drive economic growth and cut import dependence.

Dueling energy futures

Set against that backdrop, the US approach looks very different. In practical terms, Trump’s Venezuela strategy deepens reliance on heavy crude at the same time global demand for that crude may flatten. Climate wise, it keeps more carbon-intensive oil in play just as the world is trying to hold down warming and the extreme heat waves, floods and wildfires that come with it.

Li Shuo argues that the US is adopting what he calls a “petrostate approach” that risks pushing the country backward on the energy transition while showing it is still willing to use military force to secure fossil fuels. For people watching their electric bills climb during summer heat or worrying about the next hurricane season, that backward step has very real consequences.

China’s sprint toward electric mobility and clean power will not solve the climate crisis on its own. The country still burns a lot of coal, and its industrial emissions remain high. Yet the direction of travel is clear. Oil demand from its cars and buses is peaking, and the grid is getting cleaner every year.

Venezuela’s oil plays a shrinking role in that picture. For a world trying to choose between more pipelines and more charging cables, that contrast should be a wake up call. And for anyone keeping an eye on global renewables, it is also a reminder that the center of gravity is shifting east.

The press release was published on Global Energy Monitor.