That thick envelope from Cook County on your kitchen table is probably not the holiday mail you hoped for. Inside, many Chicago homeowners are opening property tax bills that are far higher than last year’s.

A new analysis from the Cook County Treasurer’s Office says this is the biggest citywide property tax jump for homeowners in roughly three decades. The same study finds that Black and brown neighborhoods on the South and West sides are being hit hardest.

Officials blame a sharp drop in downtown commercial property values, which shifts more of the tax load onto homes. To make things worse, a long-running computer upgrade delayed the mailing of second-installment bills, which are now coming due in mid-December.

Why are Chicago property tax bills jumping so sharply this year?

So what happened between last year’s bill and the one you are holding now? The Treasurer’s analysis says that Loop office, retail, hotel, and restaurant buildings lost so much value that their tax bills fell by more than $129 million compared with the previous year.

The same analysis reports that the median city homeowner bill rose about 16.7%, the largest increase in at least 30 years. Since local governments are asking for more money while downtown owners pay less, the tax system simply shifts more of the bill onto other property owners.

Also Read: Florida gas prices hit lowest since 2020

Which Chicago neighborhoods and communities are being hit the hardest?

The pain is not spread evenly across the city. According to the Treasurer’s Office, some of the biggest percentage increases are concentrated in poorer, predominantly Black neighborhoods on the South and West sides.

In West Garfield Park, the median homeowner tax bill increased about 133%; in North Lawndale, it jumped about 99%; and in Englewood, it rose roughly 82.5%.

The study also notes that home values in many of these areas have climbed quickly. Since property values are reassessed about every three years, this can cause past undervaluation to show up as a single, painful jump when homes are revalued.

What can Chicago homeowners do if they cannot afford the higher bill?

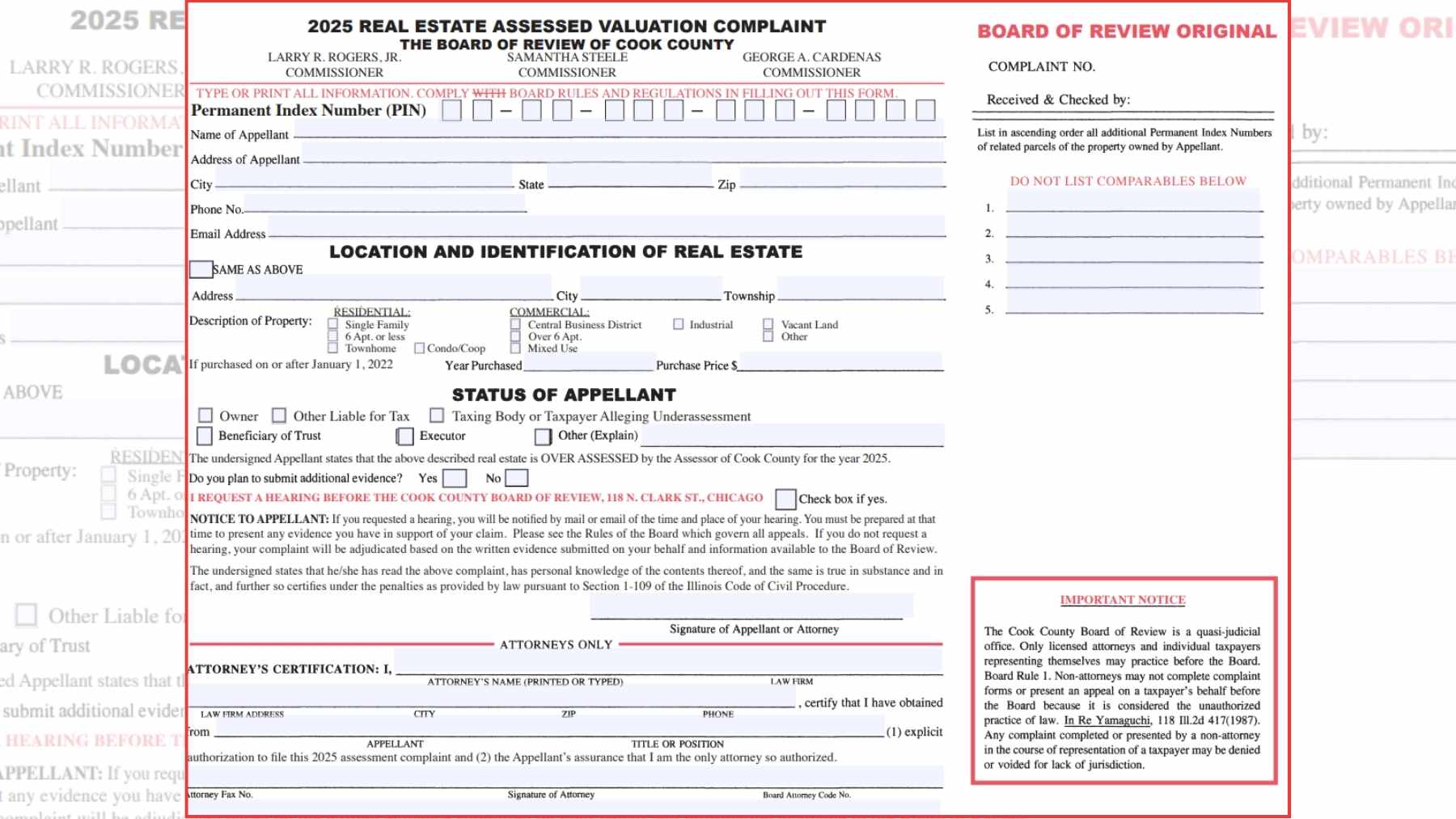

If your bill looks impossible, the first step is basic and slightly painful: read it closely. The Treasurer’s Office has posted 2024 second-installment bills online at cookcountytreasurer.com, and the paper bills are due December 15, 2025. If you cannot pay in full by then, you may make partial payments, but unpaid balances start to accrue interest of 0.75% per month after the deadline.

Official county sites lay out a few practical steps to manage the hit:

- Check your bill and your exemptions on cookcountytreasurer.com and apply for any missing exemptions.

- Use the Treasurer’s Payment Plan Calculator to spread payments over time instead of missing the deadline.

- If you think your home is overvalued, use the Cook County Assessor’s appeal calendar to challenge the value used to calculate your taxes.

The Treasurer’s analysis points out that if you fall behind, unpaid taxes usually are not put up for a tax sale, meaning a public sale of the debt, until about 13 months after the second-installment due date, though interest keeps piling up the whole time.

It is a lot of bureaucracy for one envelope, but for many households those steps may be the only way to stay in their homes while Chicago weathers this property tax shock.