General Electric spent $3.2 billion to acquire a 90 percent stake in Converteam Group, continuing its aggressive acquisition streak to bolster its profitable energy division.

Converteam is a former business unit of Alstom S.A. based in France that specializes in manufacturing high-efficiency electric power conversion components like motors, generators, drives, and automation controls.

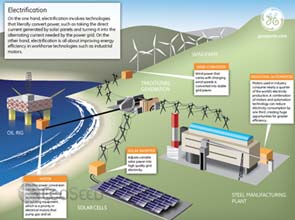

The components are used in a variety of industries at the core of G.E. energy business, including oil and gas, mining as well as solar and wind power. Motors, for instance, are used in gas pipelines while equipment to convert direct current electricity into grid ready direct current power can be tied with the conglomerate’s wind turbine and solar-photovoltaics business.

The deal, which is expected to close during the third quarter of 2011, stated that Converteam’s existing management will retain a 10 percent stake in the company, although G.E. was given the right to buy the company’s remaining shares over the next two to five years for no more than $480 million.

The acquisition should produce a growth in annual revenues of 1.1 billion euros ($ 1.55 billion), Converteam said in a statement.

In a statement released by G.E., it was estimated that the acquisition would realize $250 million in benefits annually within five years. A large portion of that will come from being more cost-efficient and profitable in areas where both companies have customers.

‘Mega-trend’

The energy efficiency, electrification, and automation industry is a $30-billion market that is growing faster than the global economy, G.E. said. About 25 percent of the world’s electricity is used to power motors, and Converteam’s products could reduce consumption in that sector by one-third, the company added.

“High-efficiency, fully electric solutions represent a megatrend across the global energy landscape. Our customers in key industries increasingly demand more reliable, efficient, and flexible solutions in order to improve their competitiveness,” John Krenicki, General Electric’s vice chairman said.

G.E. is the world’s biggest maker of power-generation equipment, and its energy division provided $37.5 billion of the parent company’s $150 billion in sales last year.

Analysts agreed that the acquisition was in line with G.E.’s quest to expand its energy business, though some noted that Converteam’s earnings before interest, taxes, depreciation and amortization for 2010 of $239 million was much smaller than the company’s $3.2 billion price tag.

The move is the latest in a string of energy company acquisitions for G.E. that started last year. It picked up Well Support, a division of Britain’s John Wood Group for $2.8 billion and Dresser, a manufacturer of natural gas engines, fuelling systems, and other components, both for $3 billion last February. It also bought Wellstream Holdings, the British oil services company, for $1.25 billion in December 2010.