BrightSource Energy, Inc. raised $201 million from investors in its most recent funding round as observers speculate that the California-based solar thermal technology project developer could go public this year.

Alstom invested $75 million in the round. Alstom, which also made a $55-

million investment in BrightSource in May 2010, is now the second largest shareholder in the solar thermal firm next to the company itself, BrightSource said.

The Series E round brings the total venture capital investment made into BrightSource to more than $530 million so far.

BrightSource said in a statement that the funding will go to building up to 14 solar thermal plants in the United States and to international expansion across the Mediterranean and Africa. The power plants in total would be in the scale of over 2.5 gigawatts.

Other investors in the recent financing round included Chevron’s venture arm Chevron Technology Ventures, British Petroleum Technology Ventures, VantagePoint Ventures Partners and Draper Fisher Jurvetson.

The company said it had new investors whose names were not disclosed.

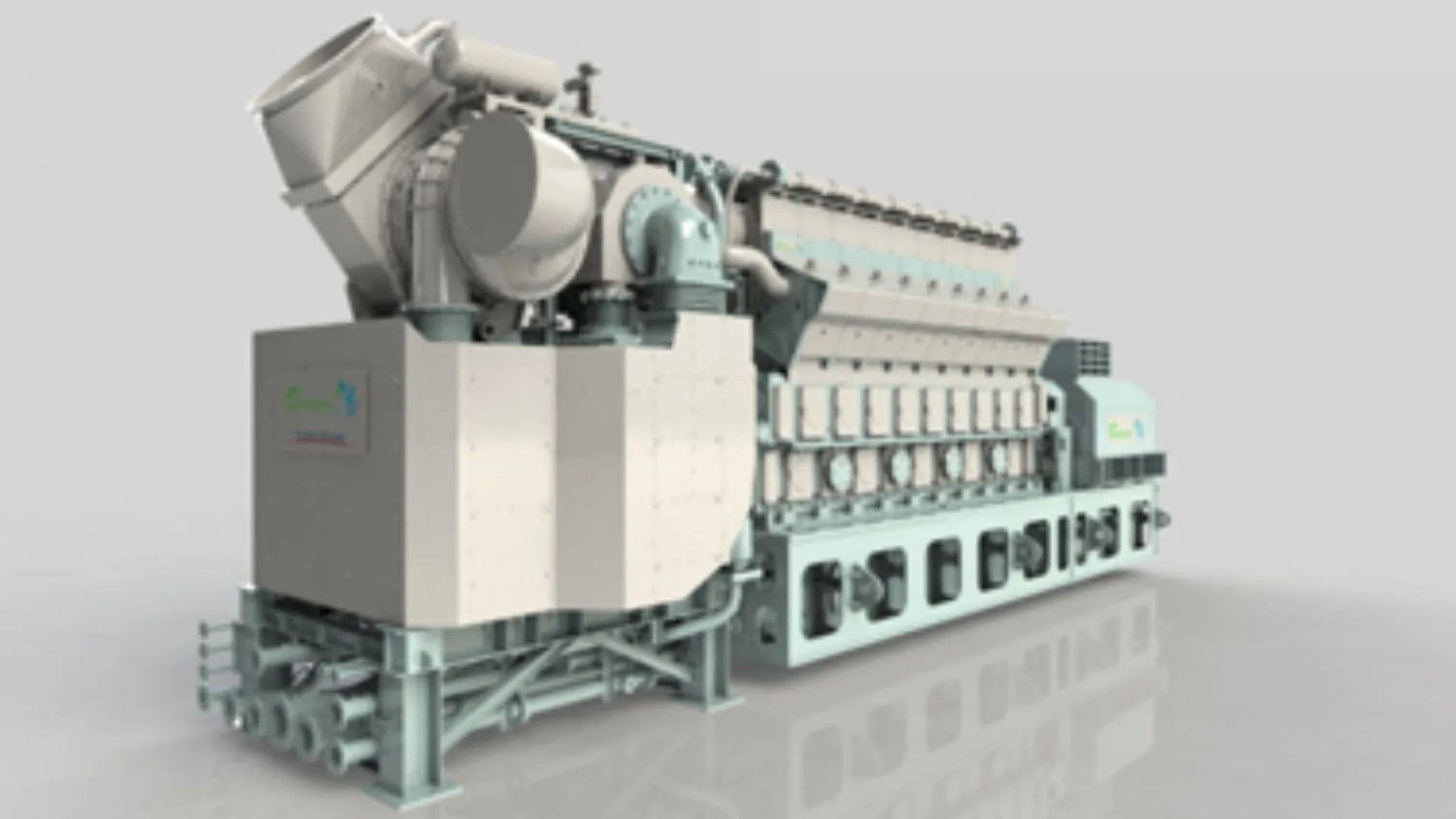

BrightSource uses thousands of mirrors called heliostats that track the sun to constantly focus sunlight on a boiler on top of a tower. The Ivanpah solar project being built in California’s Mojave Desert in San Bernardino County will use around 347,000 of these mirrors.

The focused sunlight heats the water inside the boiler’s pipes, creating steam fed to a turbine that generates electricity.

BrightSource has solar power contracts for 1,310 megawatts with California utility Pacific Gas & Electric and 1,300 MW with Southern California Edison, all through the Ivanpah facility.

Last year, BrightSource secured a $1.3-billion federal loan guarantee from the Department of Energy to finance Ivanpah, what it says is the world’s largest solar project of its kind, at 392 MW. The loan provides up to 80 percent of the Ivanpah solar power system’s cost.

Because it has shown that it could ink huge contracts and secure government and private money in numerous financing rounds, BrightSource had been on the radar for an I.P.O.

Analysts say its plans to build its 14 power plants would require billions in investments. Meanwhile, a partnership with Alstom itself, which chose BrightSource to install a solar thermal facility in aid of one of its oil fields in California, was seen as potentially setting it up for an I.P.O. this year.

Alstom had also reportedly hired Goldman Sachs and Morgan Stanley to move it for the offering. BrightSource had since not confirmed such reports.